FAB Market Insights

Stay informed with our art news and market insights.

One of the main criticisms of the art market is the opaque nature of sales data, as auction results are the only sales details published. Sales by private collectors, galleries and artists account for about 60% of sales by both number and value, but are almost never disclosed. Thus, collectors lack vital numbers on how to assess values of potential purchases. (I have to say that this opacity is not all negative, as it creates mystery and opportunity for both buyers and sellers). Valuing an artwork is not only analytical; it requires a combination of research, experience, personal inspection and, importantly, judgement.

Understand the key criteria for evaluating emerging contemporary art, and learn how to assess an artist’s vision, art market position, and investment potential.

Looking to expand your art collection? Learn how to find a qualified art broker to navigate the art market, access exclusive works, and secure fair prices.

Start confidently navigating the art market with tailored guidance for collectors and sellers. Gain clarity on trends, risks and opportunities

An important part of our role as art advisors and brokers is to advise our clients on selling single artworks or their complete collection. There are many reasons collectors want to sell certain pieces – a change of taste, moving home, taking advantage of market conditions, or the dreaded death and divorce – and most owners find the selling process fraught with difficulty and time consuming. Our team at Fine Art Brokers advises clients on works at all values, from $10,000 to $20 million, we outline all the appropriate options and discuss values, and we then either negotiate sales ourselves or arrange consignments to trusted colleagues and auction houses. We also handle all logistics, admin and insurance.

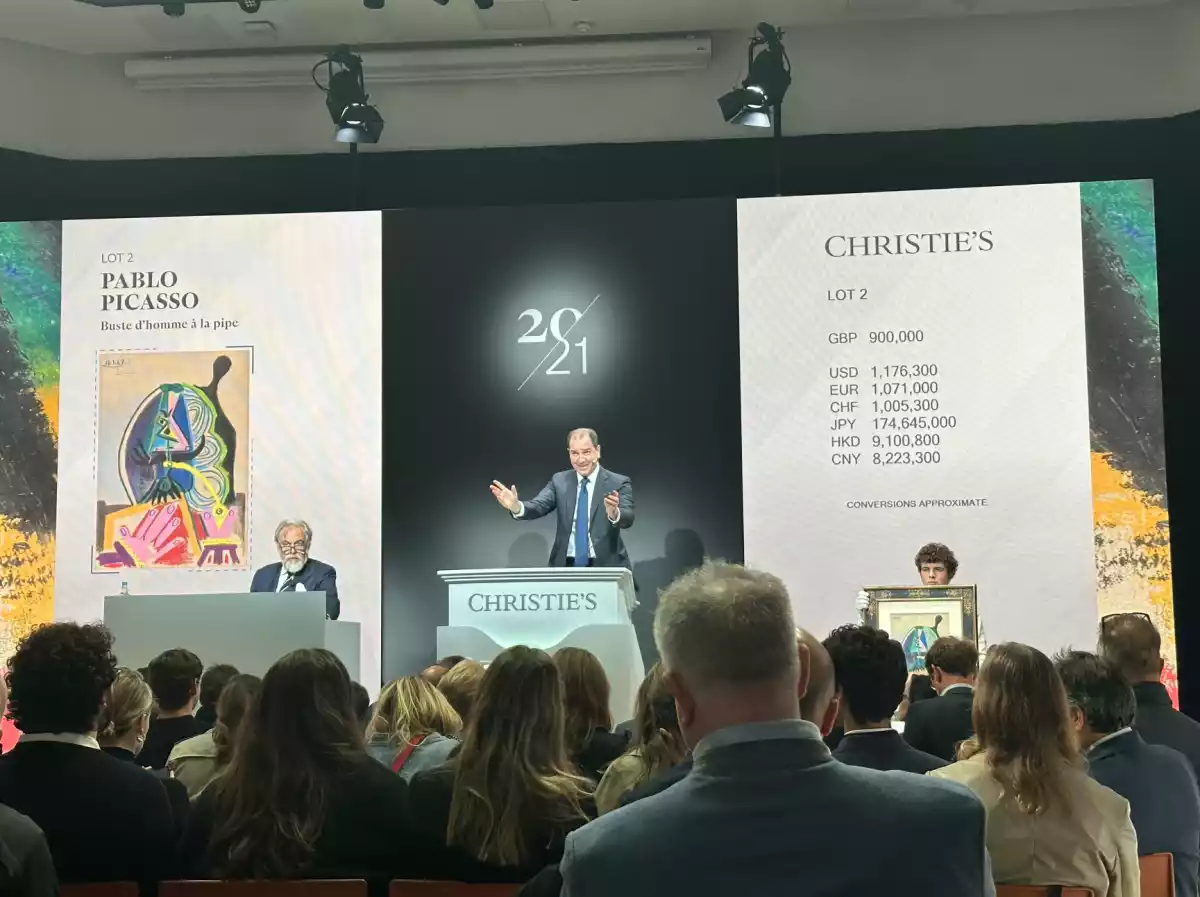

The results from the May auctions in New York created a mixture of emotions; excitement, surprises, a few disappointments, but overall confirmation that the art market is active and stable. Some artworks exceeded expectations, some of which we describe below, but overall there was a good sell through rate. Most vendors were pleased (or relieved). One of the main headlines of the week was the failure of Alberto Giacometti’s Grande tête mince at a reported reserve of $65 million. This headline grabbing flop was in fact not an example of a failing art market, rather the vendor’s initial reluctance to take a reasonable reserve and a later refusal to accept an irrevocable bid before the sale, which I believe was $55 million. I was involved in guaranteeing two other Giacometti sculptures, and both sold.

New York is the center of the art world in May, with major auctions and art fairs. FAB will be attending all these events, so please contact us if you want to view with us or have our opinion if you cant make it yourself.

While the stock markets are currently in turmoil due to Trump’s tariffs, a situation which changes daily and sometimes hourly, the art market breathed a sigh of relief last week when it emerged that artworks entering the US will be exempt from tariffs. While this may change, and existing import taxes into other countries remain (5% VAT in UK, 6% in Europe, higher in some other countries), the US tariff situation is hugely significant given that the US is the most important market for art, with 43% of sales by value.

Fine Art Brokers arranges museum loans of certain works acquired through us, or already in our clients’ collections. Loans to prestigious museums have two main functions: they contribute to the cultural community, and also help to increase the value of the loaned works – art historically and also financially.

With interest rate uncertainty, strife in the Middle East and elsewhere, and the US election nearly upon us, many collectors and art world insiders were holding their breath in anticipation of the market performance in the busy month of October. In London and Paris there were major auctions, art fairs and exhibitions, and as I write The Art Show in New York is taking place. The good news is that we can all gently exhale – while the art market certainly isn’t what it was 2 years ago, it’s still alive and relatively well.

We are pleased to outline a guide to the major fairs for the next 5 months. Our team will be attending most of these so please contact us if you wish to join us.

Expressionists: Kandinsky, Münter and the Blue Ride at Tate Modern, London April 25th to October 20th, 2024 Expressionists: Kandinsky, Münter and the Blue Rider explores the work of the artists that made up The Blue Rider group.

Clients have been asking me recently about the state of the art market and specifically if this is a good time to buy, or alternatively a good time to sell. My short, honest answer has been that the market is less buoyant than last year and certainly less than 2022; gallery and auction sales are down in value and number; but overall the market is still solid and, one might say, surprisingly resilient; and there are opportunities for both buyers and sellers. Those opportunities must be well chosen though, with research and advice, as demand varies a lot in different sectors.

FEBRUARY *1 February: Barbara Kruger: Thinking of You. I Mean Me.

After 40 years working in the art market, I have met many highly successful people who, despite their life and work experience, were too intimidated when walking into an art gallery or auction house to discuss what they saw. On the other hand, there are even more examples of successful business people who aren’t apprehensive at all, and believe they can transfer their winning mentality to buying art. And there are other collectors or would-be collectors who simply don’t have the time or expertise to buy wisely.

With much overdue institutional attention on important female artists, it's easy to think that the playing field is starting to become equal - but how far do we have to go to approach gender equality, and how is it measured and valued in the art world? What are the numbers telling us?

Building an art collection should be an extremely satisfying and rewarding experience. But whether you’re looking to acquire art for decorative or investment purposes — for most new collectors it is usually a combination — it can be difficult to know where and how to start.

Our directors arrived back from Miami for a few days in New York before jetting off to London. Art Basel Miami Beach has been, as usual, the subject of much attention after a mixed auction season here in New York that resulted in record-shattering highs and some middling lows.

After a 10-day trip to South Korea in late August, checking out the art market and visiting Frieze Seoul, our directors are now back in New York geared up for a very busy season of art fairs, exhibitions and auctions. This week marked the start of the fall auction season in New York, with Contemporary sales at Phillips, Christie's, and Sotheby's.

From a $40 million sculpture to a £37.5 million Francis Bacon portrait, the FAB team rounds up the news from our travels in Europe.

As the FAB team heads abroad for the London auctions and European art fairs, we take a look back at the May 2022 auction season and what it might indicate for the coming months.

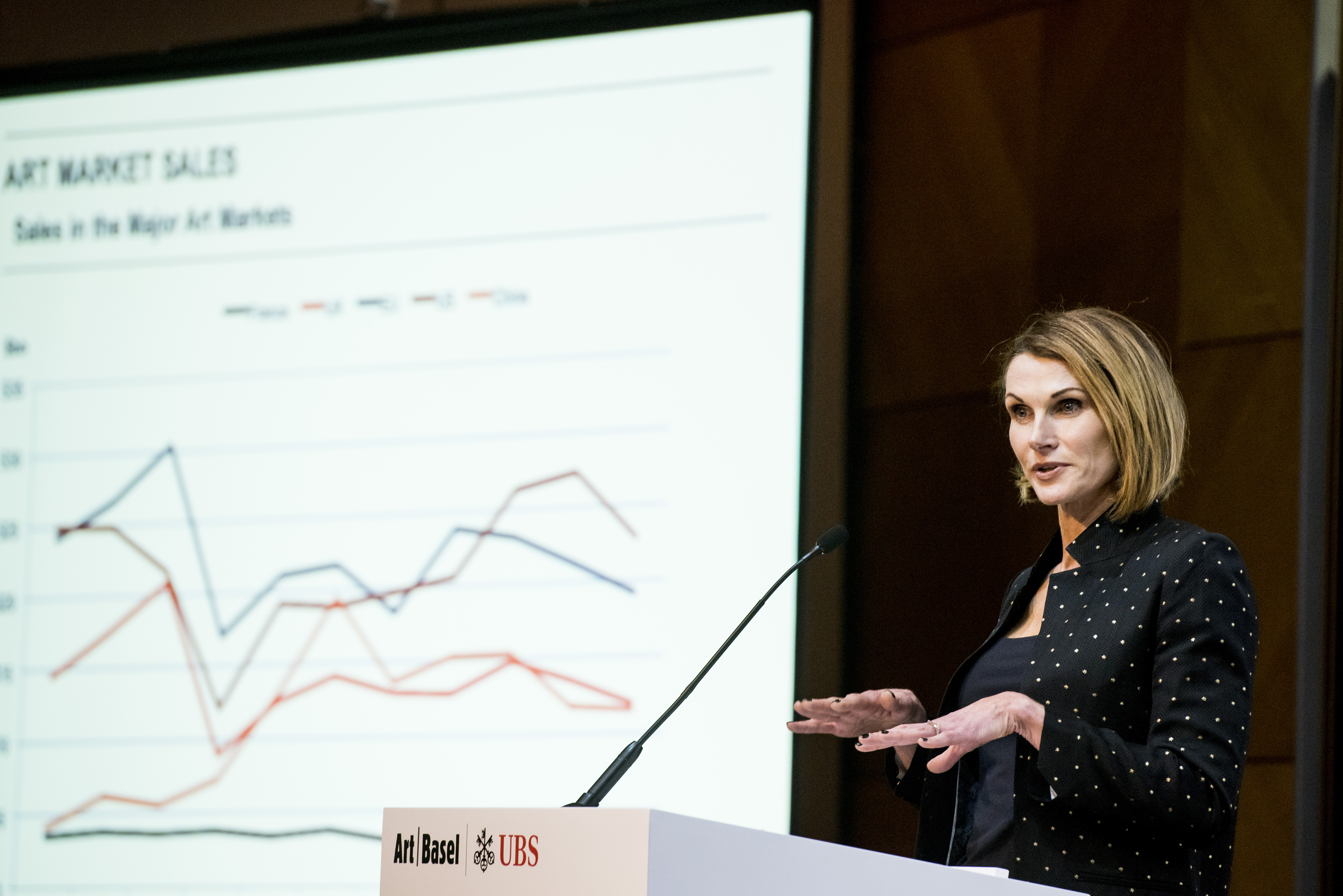

Following its biggest recession in 10 years, the global art market bounced back to above pre-pandemic levels in 2021, with aggregate sales of art and antiques by dealers and auctioneers reaching $65.1 billion, up 29% from 2020. Yet that recovery was uneven, notes cultural economist Clare McAndrew in the sixth edition of the Art Basel and UBS Global Art Market report.

After two years of unprecedented change in the art market, with some sectors seeing enormous gains, all bets are off when it comes to making predictions about trends for this year. But as we embark on another year of activity at Fine Art Brokers, we attempt mission impossible.

Building an art collection can be an extremely satisfying and rewarding experience. But it can also be a daunting one. Whether you’re looking to acquire art for decorative or investment purposes — for most new collectors it is usually a combination — it can be difficult to know where to start.

Buying art online is becoming increasingly popular, and not just because of Covid-related travel restrictions. In 2020 aggregate online sales for auctions reached a record high of $12.4 billion, while the share of online sales for dealers rose from 13% in 2019 to 39% in 2020

With the world in and out of lockdown over the past 18 months, it’s been a turbulent time for the art market. Sales have inevitably dropped, but both sellers and buyers have adapted to the enforced reality that most artworks have been offered online, with the result that sales have held up well. In 2020, during the worst period of the pandemic, global sales of art and antiques still reached over an estimated $50 billion — down just 22% on 2019 and 27% since 2018 — notes Dr. Clare McAndrew in the industry leading 2021 Art Basel UBS report. Sales of fine art at auction dropped by around 30% from 2019, but Sotheby’s and Christie’s both compensated by reporting at least a 50% increase in private sales.

At Fine Art Brokers we are often asked if an artwork that someone has purchased or inherited has monetary value. Here we give a rough guide to help you understand value. Many of the comments might appear to dismiss the artistic nature of a work of art, something that has been created from the artist’s skill and imagination. We do not wish to denigrate these aspects in any way, as an artist’s creation is usually a beautiful and wonderful thing – we are simply describing market factors.

With so many factors to consider for investing in fine art, it is important to prepare and educate yourself when collecting artwork. In this article, Fine Art Brokers breaks down the steps to consider when it comes to investing in art. Check out our complete guide here.

A good advisor will be able to help a collector navigate the (often rapidly) shifting sands with regard to art sales tax and import duty taxes on art and associated duties and levies on art acquisitions. While it may be unfair to expect an advisor or broker to understand the applicable tax rates in every scenario, advice can be given to help a collector avoid expensive errors or unforeseen costs. Here we give general information to help you know which issues are important to resolve about sales and import taxes before you purchase or move a work of art.

For those taking their first steps in collecting, as well as for those experienced in buying and selling art, there are many advantages to using an art advisor. In this article, we discuss how a good advisor can help a new collector gain confidence and see through the opaque facets of the art world, especially the various buying opportunities and what drives an artist’s value. We also outline how an advisor’s expertise and inside knowledge allows clients access to art not generally available, and guidance in choosing the right artworks to purchase. Buyers and sellers of art at all levels can benefit from an advisor’s market knowledge and due diligence. And we finally detail how good advice need not be expensive; in fact, we contend that advisors often save their clients’ money.

If it is your first time viewing or participating in an art auction, you’ll need a number of pointers about how to understand the many aspects involved, including the terminology used, how to bid, and the charges. Auctions can be both exciting and intimidating for the uninitiated, with many ‘experts’ and apparently well-heeled clients with their advisors making you feel the art world is a mysterious place. But don’t let this scare you, as with the right guidance and some preparation you can find the confidence to make informed decisions about your bidding. Auctions have an enormous variety of art to offer, online and in real life, and getting involved can be educational, rewarding, and sometimes even fun, once you have the experience and confidence. Doing your research, knowing what questions to ask, having a bidding strategy, understanding the players, and considering using a consultant are what you’ll need to prepare before bidding at auction.

The big auction houses have ripped up their usual autumn schedule and have packed October with a huge array of auctions, more a ‘eat all you can buffet’ than a carefully curated and planned series. As MutualArt blog wrote, the auctions are trying to cash in with as many lots as possible “in today’s half-certainty versus tomorrow’s uncertainty”.

Fine Art Brokers is pleased to offer complimentary replay access to our latest webinar 'How to Buy Art Online with Confidence'. Join our CEO, Ray Waterhouse, for an in-depth conversation with Courtney Kremers (Sotheby's), Susanne Siano (Modern Art Conservation), and Liz Luna (Artsy) on online buying guidelines.

Fine Art Brokers is pleased to offer complimentary access to the replay of our June webinar, Planning Strategies for Art & Collectibles: Managing the Disposition of an Art Collection. We hope you will enjoy this discussion with valuable insights on the art market during Covid-19 and many aspects of Art Advisory, Art Law, and Auction practice. For On Demand viewing please click here.

Fine Art Brokers hope that all our friends, clients, colleagues and peers in the trade stay well and healthy. As art market professionals, we have been approached by numerous collectors over the last month for advice and opinion on the effect of the global Covid-19 crisis on the art market. Here we outline our initial thoughts, although all of our experts in New York and London are happy to speak in more depth to collectors and consignors on a one-to-one basis.

To our valued audience and event invitees, kindly note we have postponed this event until the Autumn, 2020. For the full update please click through to our news section, or contact us directly for additional information.

Jean-Paul Riopelle developed his mature style in the early 1950s: tessellated canvases that unfold like constellations, their heavy impasto applied with a palette knife directly from the tube of paint. Living in Paris and exhibiting worldwide, including at the Solomon R. Guggenheim Museum and with Pierre Matisse Gallery from 1953–89 – which was owned by the son of Henri Matisse and promoted the European avant-garde in the US – Riopelle became the most internationally acclaimed Canadian artist of his generation. This holds still more true today, with prices for the artist’s work reaching unprecedented heights.

Over the past 20 years, art fairs have become an increasingly important part of the art market. Many sell a particular type of art that suits the local clientele, while some have expanded into ‘destination’ fairs which attract visitors from around the world. But with the best fairs, which are few in number, the locality of the fair helps to define its character.

Bridget Riley has been a mainstay of the Modern British and Contemporary art market for many years but her secondary market prices have not always been so high. Over the last 2 or 3 years, we have witnessed a significant rise in her prices generally, which has been accompanied by a reappraisal of her later work.

2019 saw a major retrospective of the Surrealist painter Dorothea Tanning at Tate Modern. Tanning’s retrospective is part of an upswing of interest in female Surrealists in popular media, museum exhibitions and the art market. Now is a good time to buy the works of female Surrealists, whose work has still not found an upper limit.

The principle three auction houses in London all held their major sales in Modern British Art last week. Although the auctions only represent one aspect of this thriving market it is still useful to analyse their results to take stock of general trends and collecting habits.

The most important single-owner sale ever to hit the auction block comes up next week at Christie's New York. The world-renowned collection of Peggy and David Rockefeller has a number of major masterpieces worthy of the best museums, and many other very high-quality works for which top collectors will compete.

There have never been more opportunities to buy fine art and be well informed, given the extraordinary range of art fairs, auctions, dealers and galleries - all accessible in person and online, as well as the increasingly informative online art platforms. What to choose is the problem.

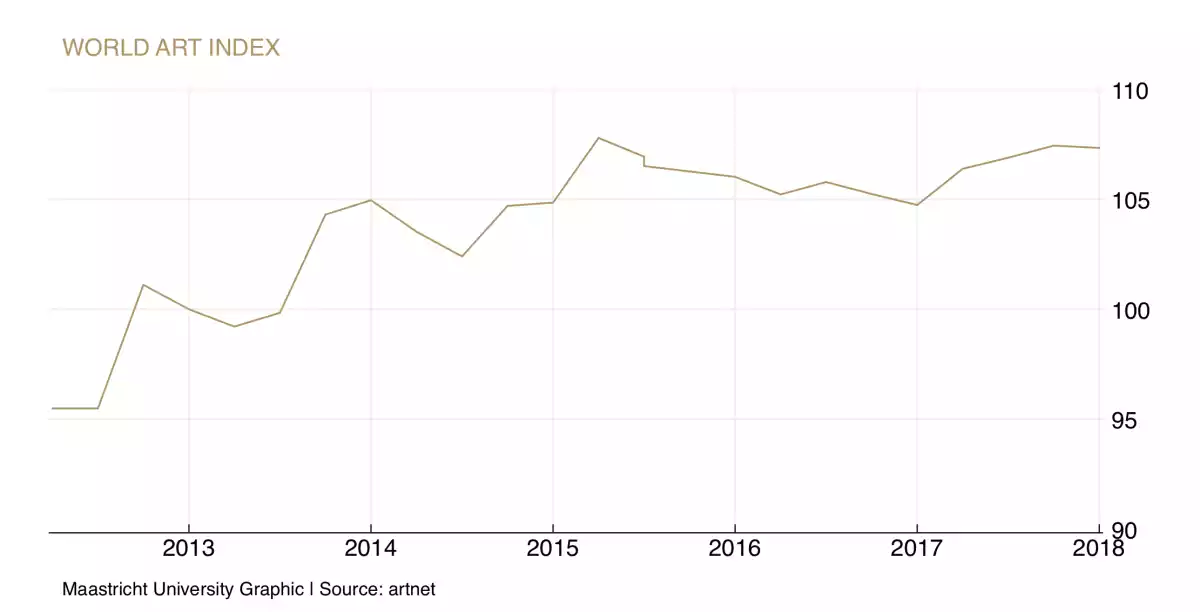

Global auction sales provide a barometer for how the art market is performing. During 2017 we experienced a rise in world auction sales, following a steep decline during 2016, when the US and UK auction sales markets dropped in terms of sales. Much of this drop in sales revenue during 2016, as recorded by a fall in volume, can be attributed to a shift in sales to the dealer market.

Ray Waterhouse, Chairman of Fine Art Brokers, and Judd Tully, seasoned writer on the art market and Editor-at-Large for Art + Auction magazine, present a private talk on starting and building an art collection, hosted at a magnificent penthouse in downtown New York.

Fine Art Brokers introduces Sotheby's and Christie's Impressionist & Modern evening sales, New York, 2016.

Bowie’s collection is as eclectic as its creator's musical output, a reflection of his modus operandi whereby he sought to ‘collect ideas’ above any fixed group or theme, although his core interest was clearly mid-century British Art.

Last Wednesday, October 26th saw the first fair run by The European Fine Art Foundation (TEFAF) come to an end in New York, after a five day run. The reaction from visitors and exhibitors was very positive.

Fine Art Brokers is pleased to be represented at the 51st Annual Heckerling Institute on Estate Planning. Considered the largest national conference of its kind, the annual event will take place in Orlando from January 9-13th, 2017.

The first part of an occasional guide, both informative and irreverent, to the art world’s usage and abusage of the English language, originally written by us in 1991 but still surprisingly relevant.

What have we learned from the recent auctions in New York and the main art fairs - Spring Masters, Frieze, and Art New York? In short, we have learned that there is still excellent demand for good quality works of art but a lack of available masterpieces and top-quality works, in general, resulted in much lower sales totals than May 2015.

Boom years in any market are usually characterized by rapid price rises by particular artists or groups. For what is classified ‘Modern British Art’, which is broadly speaking art executed in a modern and progressive style between 1900 and 1980, the Scottish Colourists and the Newlyn School defined the boom years of the late 1980s and in the 2000-2008 period Post-War Abstraction, particularly St Ives artists, became highly collectible.

Between May 5 and May 15, the main New York auction houses will feature no fewer than 11 sales comprised of Impressionist, Modern, Post-War and Contemporary Art. Monet takes center stage with 10 canvases, four of which are estimated at or above $15 million, Giacometti and Picasso are also poised to break records.