FAB Market Insights

Stay informed with our art news and market insights.

Start confidently navigating the art market with tailored guidance for collectors and sellers. Gain clarity on trends, risks and opportunities

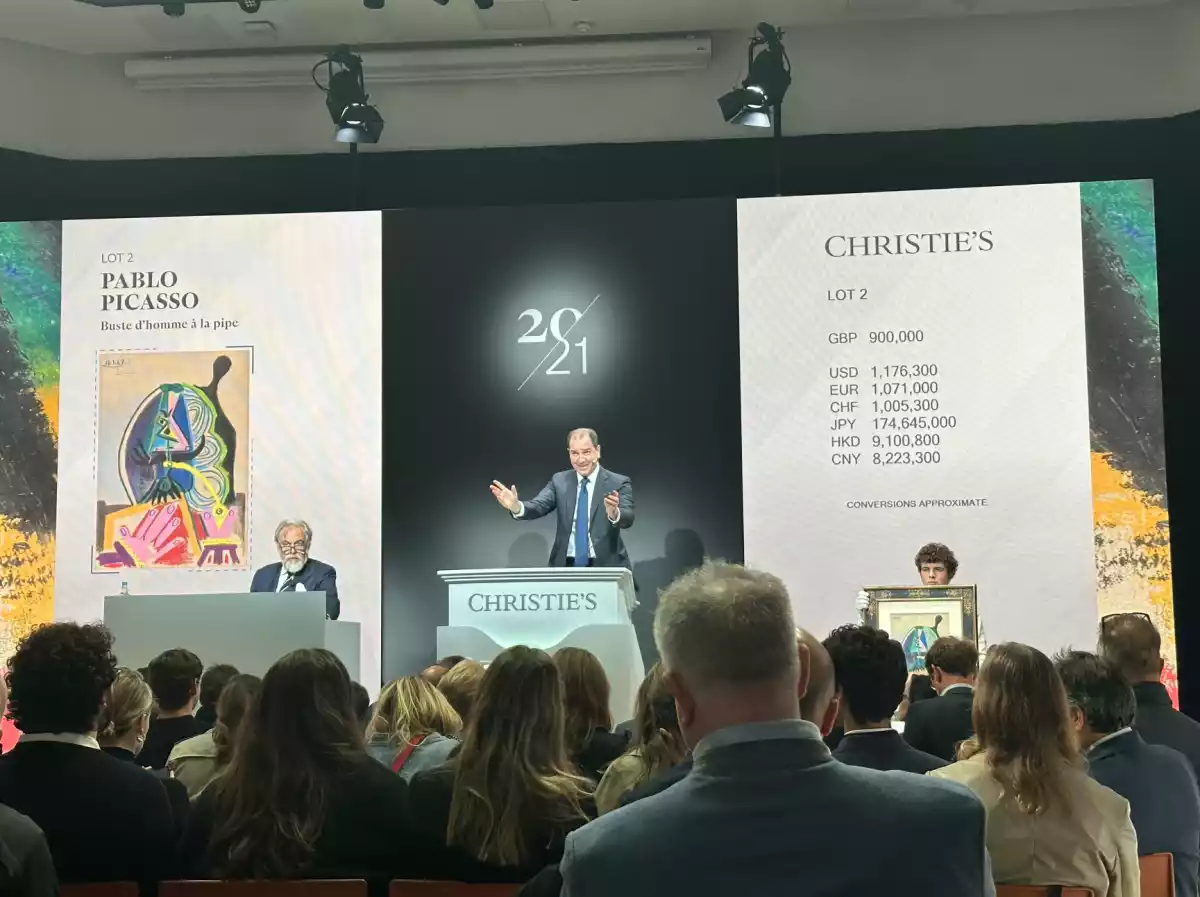

An important part of our role as art advisors and brokers is to advise our clients on selling single artworks or their complete collection. There are many reasons collectors want to sell certain pieces – a change of taste, moving home, taking advantage of market conditions, or the dreaded death and divorce – and most owners find the selling process fraught with difficulty and time consuming. Our team at Fine Art Brokers advises clients on works at all values, from $10,000 to $20 million, we outline all the appropriate options and discuss values, and we then either negotiate sales ourselves or arrange consignments to trusted colleagues and auction houses. We also handle all logistics, admin and insurance.

While the stock markets are currently in turmoil due to Trump’s tariffs, a situation which changes daily and sometimes hourly, the art market breathed a sigh of relief last week when it emerged that artworks entering the US will be exempt from tariffs. While this may change, and existing import taxes into other countries remain (5% VAT in UK, 6% in Europe, higher in some other countries), the US tariff situation is hugely significant given that the US is the most important market for art, with 43% of sales by value.

With interest rate uncertainty, strife in the Middle East and elsewhere, and the US election nearly upon us, many collectors and art world insiders were holding their breath in anticipation of the market performance in the busy month of October. In London and Paris there were major auctions, art fairs and exhibitions, and as I write The Art Show in New York is taking place. The good news is that we can all gently exhale – while the art market certainly isn’t what it was 2 years ago, it’s still alive and relatively well.

Clients have been asking me recently about the state of the art market and specifically if this is a good time to buy, or alternatively a good time to sell. My short, honest answer has been that the market is less buoyant than last year and certainly less than 2022; gallery and auction sales are down in value and number; but overall the market is still solid and, one might say, surprisingly resilient; and there are opportunities for both buyers and sellers. Those opportunities must be well chosen though, with research and advice, as demand varies a lot in different sectors.

After 40 years working in the art market, I have met many highly successful people who, despite their life and work experience, were too intimidated when walking into an art gallery or auction house to discuss what they saw. On the other hand, there are even more examples of successful business people who aren’t apprehensive at all, and believe they can transfer their winning mentality to buying art. And there are other collectors or would-be collectors who simply don’t have the time or expertise to buy wisely.

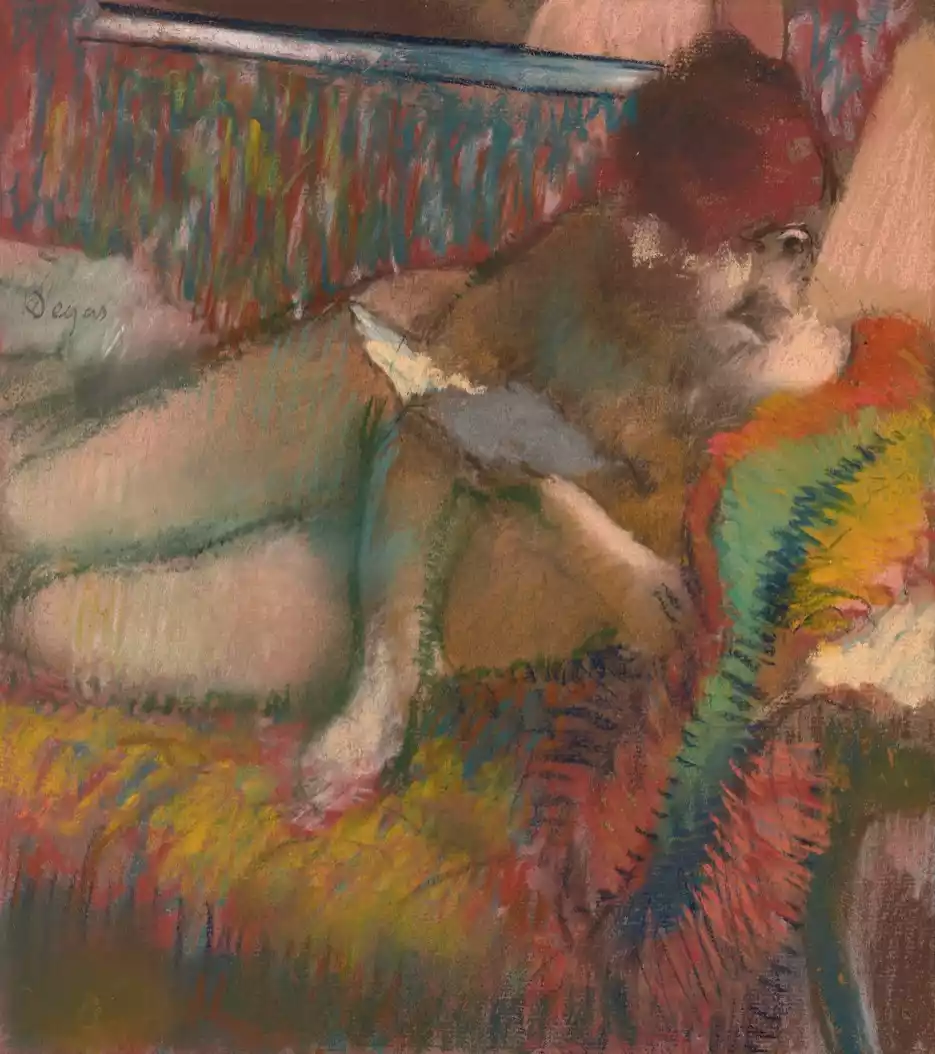

With much overdue institutional attention on important female artists, it's easy to think that the playing field is starting to become equal - but how far do we have to go to approach gender equality, and how is it measured and valued in the art world? What are the numbers telling us?

Building an art collection should be an extremely satisfying and rewarding experience. But whether you’re looking to acquire art for decorative or investment purposes — for most new collectors it is usually a combination — it can be difficult to know where and how to start.

Our directors arrived back from Miami for a few days in New York before jetting off to London. Art Basel Miami Beach has been, as usual, the subject of much attention after a mixed auction season here in New York that resulted in record-shattering highs and some middling lows.

After a 10-day trip to South Korea in late August, checking out the art market and visiting Frieze Seoul, our directors are now back in New York geared up for a very busy season of art fairs, exhibitions and auctions. This week marked the start of the fall auction season in New York, with Contemporary sales at Phillips, Christie's, and Sotheby's.

From a $40 million sculpture to a £37.5 million Francis Bacon portrait, the FAB team rounds up the news from our travels in Europe.

As the FAB team heads abroad for the London auctions and European art fairs, we take a look back at the May 2022 auction season and what it might indicate for the coming months.

After two years of unprecedented change in the art market, with some sectors seeing enormous gains, all bets are off when it comes to making predictions about trends for this year. But as we embark on another year of activity at Fine Art Brokers, we attempt mission impossible.

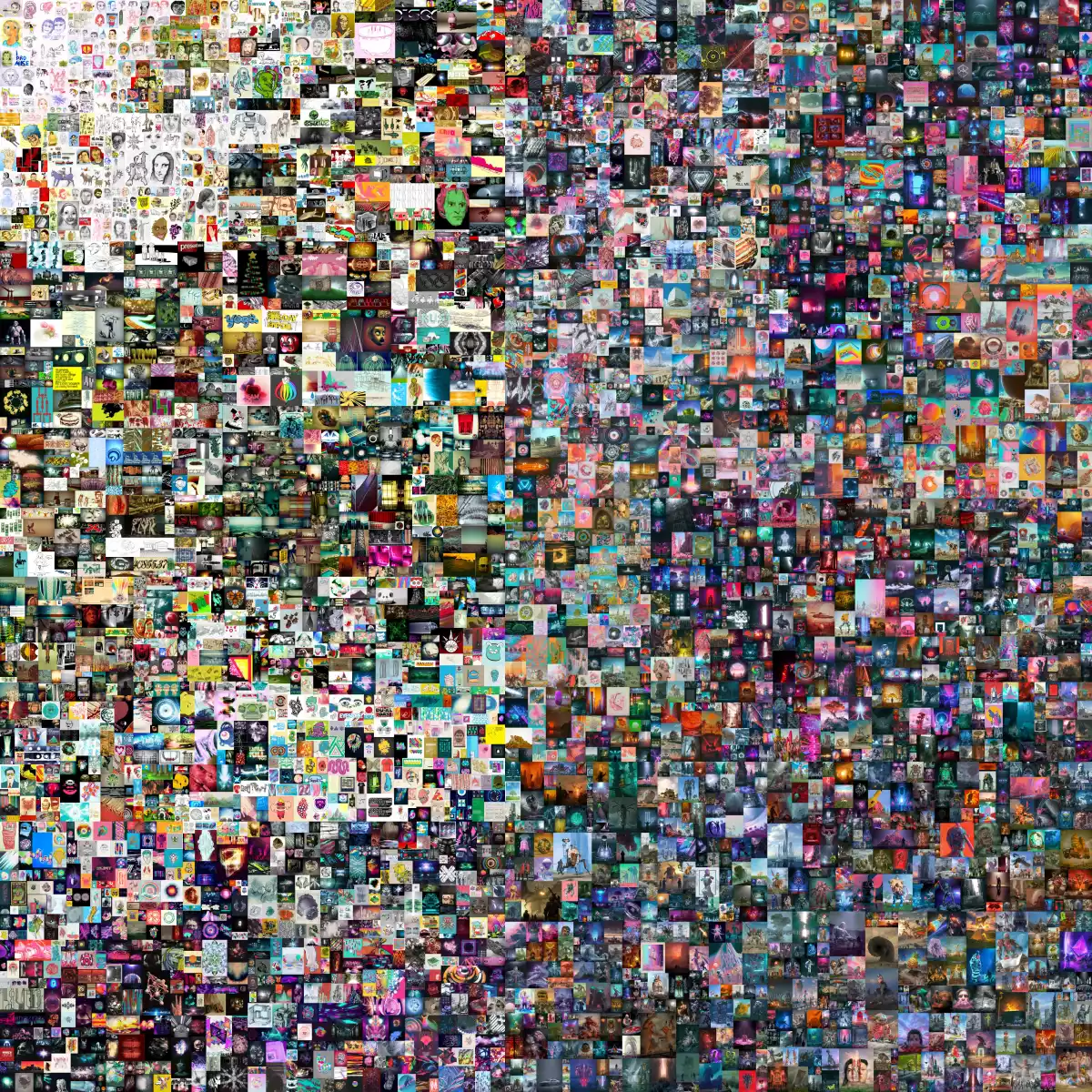

Buying art online is becoming increasingly popular, and not just because of Covid-related travel restrictions. In 2020 aggregate online sales for auctions reached a record high of $12.4 billion, while the share of online sales for dealers rose from 13% in 2019 to 39% in 2020

With the world in and out of lockdown over the past 18 months, it’s been a turbulent time for the art market. Sales have inevitably dropped, but both sellers and buyers have adapted to the enforced reality that most artworks have been offered online, with the result that sales have held up well. In 2020, during the worst period of the pandemic, global sales of art and antiques still reached over an estimated $50 billion — down just 22% on 2019 and 27% since 2018 — notes Dr. Clare McAndrew in the industry leading 2021 Art Basel UBS report. Sales of fine art at auction dropped by around 30% from 2019, but Sotheby’s and Christie’s both compensated by reporting at least a 50% increase in private sales.

Fine Art Brokers is pleased to offer complimentary access to the replay of our June webinar, Planning Strategies for Art & Collectibles: Managing the Disposition of an Art Collection. We hope you will enjoy this discussion with valuable insights on the art market during Covid-19 and many aspects of Art Advisory, Art Law, and Auction practice. For On Demand viewing please click here.

Fine Art Brokers hope that all our friends, clients, colleagues and peers in the trade stay well and healthy. As art market professionals, we have been approached by numerous collectors over the last month for advice and opinion on the effect of the global Covid-19 crisis on the art market. Here we outline our initial thoughts, although all of our experts in New York and London are happy to speak in more depth to collectors and consignors on a one-to-one basis.

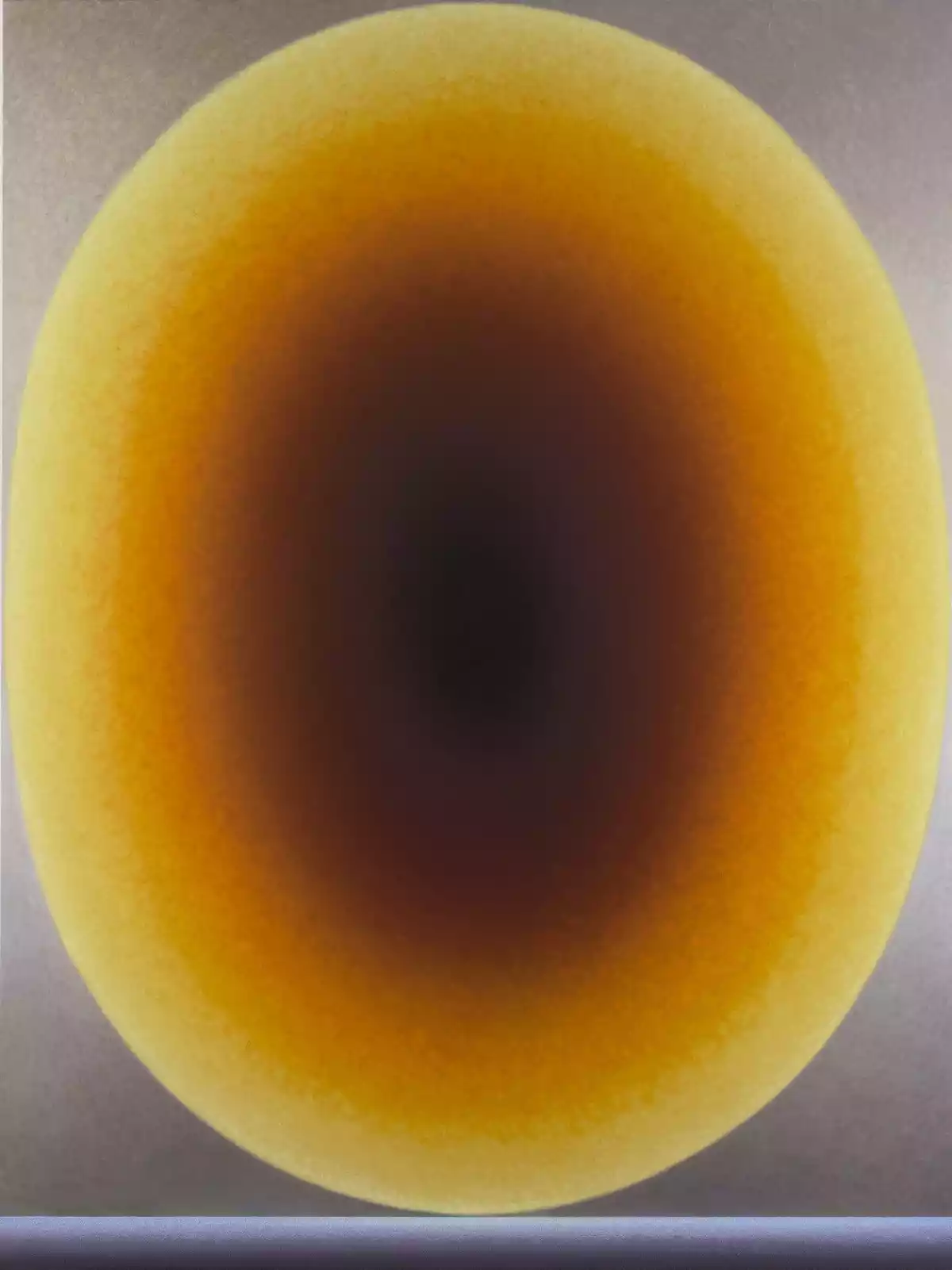

Jean-Paul Riopelle developed his mature style in the early 1950s: tessellated canvases that unfold like constellations, their heavy impasto applied with a palette knife directly from the tube of paint. Living in Paris and exhibiting worldwide, including at the Solomon R. Guggenheim Museum and with Pierre Matisse Gallery from 1953–89 – which was owned by the son of Henri Matisse and promoted the European avant-garde in the US – Riopelle became the most internationally acclaimed Canadian artist of his generation. This holds still more true today, with prices for the artist’s work reaching unprecedented heights.

There have never been more opportunities to buy fine art and be well informed, given the extraordinary range of art fairs, auctions, dealers and galleries - all accessible in person and online, as well as the increasingly informative online art platforms. What to choose is the problem.

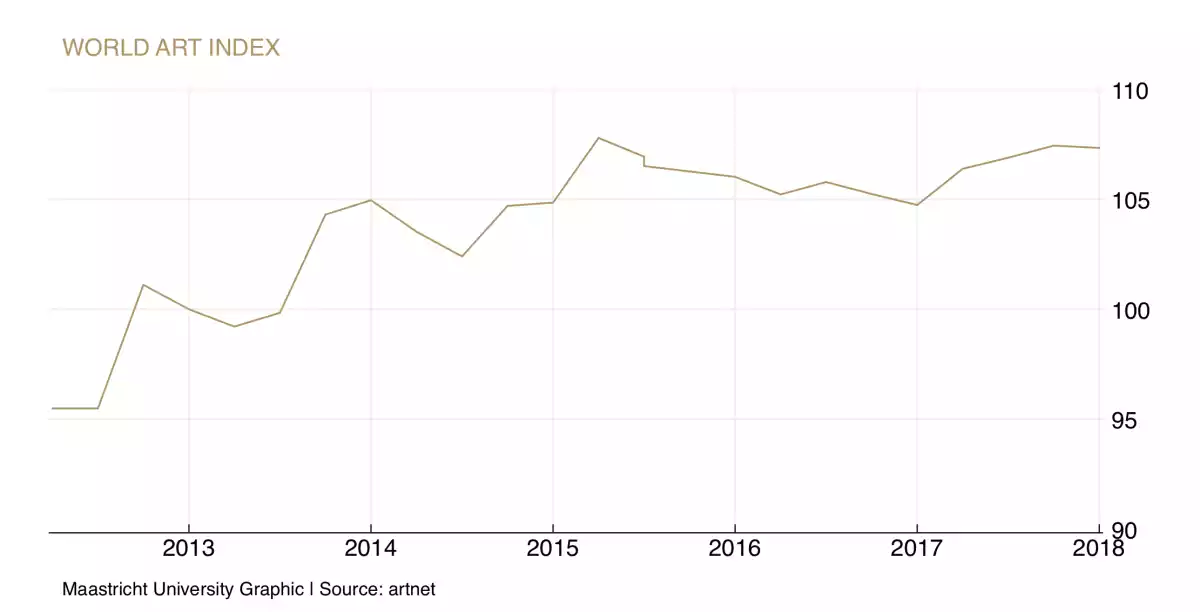

Global auction sales provide a barometer for how the art market is performing. During 2017 we experienced a rise in world auction sales, following a steep decline during 2016, when the US and UK auction sales markets dropped in terms of sales. Much of this drop in sales revenue during 2016, as recorded by a fall in volume, can be attributed to a shift in sales to the dealer market.

What have we learned from the recent auctions in New York and the main art fairs - Spring Masters, Frieze, and Art New York? In short, we have learned that there is still excellent demand for good quality works of art but a lack of available masterpieces and top-quality works, in general, resulted in much lower sales totals than May 2015.

Boom years in any market are usually characterized by rapid price rises by particular artists or groups. For what is classified ‘Modern British Art’, which is broadly speaking art executed in a modern and progressive style between 1900 and 1980, the Scottish Colourists and the Newlyn School defined the boom years of the late 1980s and in the 2000-2008 period Post-War Abstraction, particularly St Ives artists, became highly collectible.