FAB Market Insights

Stay informed with our art news and market insights.

Part of the FAB team recently returned from visiting BRAFA Art Fair in Brussels and The European Fine Art Fair (TEFAF) in Maastricht which took place in late June and July. Both fairs had moved from their usual slots of January and March respectively, and while most exhibitors we spoke to were reasonably happy with sales they also spoke of their desire to return to the traditional schedule, not least at TEFAF where there was no air conditioning. There was certainly no frenzied buying, not surprising as these fairs followed on from Art Basel and preceded Masterpiece, the major art fair in London, and also London auction week.

The London auction week was very solid in terms of results, but not spectacular as the New York May sales. The mood at Masterpiece was similar to that at TEFAF and BRAFA – reasonable sales and good attendance – but with such a vast array of buying opportunities in a four-week period there was clearly too much the market to swallow with unbridled enthusiasm.

Having said that, despite the downward trending of the stock market, the crash of cryptocurrency, and increasing inflation around the world, the art market continues to hold steady, and there were some notable results, some of which we report below.

Joan Mitchell, Bergerie, 1961-1962, oil on canvas. Sold at Pace Gallery Art Basel for $16.5 million.

Art Fairs

The art world’s annual pilgrimage returned in full force this year with many travelling to Art Basel in June. The pandemic seems truly over for the art world, and VIP previews were reportedly crowded, which some galleries complained got in the way of doing actual business.

Opening day at Basel was heralded by the sale of Louise Bourgeois’ Spider (1994) at Hauser & Wirth. Though arranged in advance, it remained the highest price of the fair, selling for $40 million and marking one of the top prices for Bourgeois and for a female artist generally. Though the artist’s auction prices have dipped in recent years, this high profile sale might bolster the continuing, sustained interest in female artists that was established throughout the season in New York.

Other six- to eight-figure prices were achieved by David Zwirner, Pace, Thaddeus Ropec, and the mega conglomerate gallery LGDR. Several reported top sales were by female artists; Joan Mitchell’s Bergerie (1961-1962), sold for $16.5 million at Pace (having previously made $5.5 million at Christie’s New York in 2015). David Zwirner also sold a Marlene Dumas for $8.5 million and an Alice Neel for $3.5 million.

This year, Art Basel adjusted its formerly strict exhibition requirements, allowing galleries open for less than three years and those without a physical space to apply. These changes enabled gallerists like Marianne Ibrahim (who represents Amoako Boafo) to exhibit at the fair for the first time. Along with the inclusion of new booths, the trend for emerging artists continued, with many galleries adding new artists to their roster of established figures. These in-demand artists were apparently mostly sold through a flurry of marketing and sales PDFs sent out by galleries before their works ever made it to the fair. It begs the question of whether viewing major works at an art fair is becoming like a museum view, given that most works are presold.

Some concerns were also raised about a lack of “freshness” to the secondary market works on offer and the high prices at the fair. A Michael Armitage was sold at White Cube after being purchased three years ago at auction. Similarly, a Francis Bacon Pope painting that was sold at Sotheby’s for $6.6 million by the Brooklyn Museum in 2019 was offered at $15 million by Helly Nahmad. Nevertheless, there was enough demand that both works sold by the end of the first day.

As advisors with extensive global connections, Fine Art Brokers can help clients purchase art before it reaches art fairs and major auctions.

Caterina Angela Pierozzi, Gabriel and the Virgin, 1677, tempera and gold leaf on vellum, 5 3/4 x 7 5/8 inches. Colnaghi Gallery.

As written above, changes to the usual pre-pandemic art world calendar led to multiple fairs being held in June, forcing both galleries and visitors to choose which fairs to attend. Some galleries chose only to exhibit at one or two options instead of trying to manage enough stock for three or four different fairs scattered across Europe. The Venice Biennale also continues while others travelled to the traditional post-Basel destination on the island of Hydra in Greece where Jeff Koons’ recently opened a new solo exhibition, Apollo.

At TEFAF, reported sales were not quite as sensational as Basel, but museum buyers turned up to the fair in force, with major institutions such as the Metropolitan Museum, British Museum, and Louvre all sending representatives. In total, the fair had reported around 100 different museums who sent staff to view and purchase at the fair.

Much like the contemporary market, there was demand for female Old Master painters with collectors and museums alike, no doubt encouraged by the added benefit of much lower prices for these works. A miniature of Gabriel and the Virgin by Caterina Angela Pierozzi was one of the headlining pieces at TEFAF, brought by Conalghi Gallery. Previously believed to be lost, it is now the first-discovered and only known work by Pierozzi in existence. Other artists exhibited, including Giovanna Garzon, were significant in their own time and are only now being reconsidered by the art market. Garzon was directly commissioned by the Medici family work, showing the esteem for her art at the time.

Dickinson Galley had likely one of the priciest modern works of the fair, a double-side painting by Giorgio de Chirico, which was estimated to be around €12m. One source told us that Dickinson hadn’t sold it by the end of the fair. At Christopher Bishop Fine Art, a Dutch old master drawing of Maerten Tromp made waves for being a ‘sleeper’ or an important (and usually valuable) artwork that goes undetected for what it truly is. The drawing was offered with an estimate of $250 at a Massachusetts auction house where it was noticed by several other eagle-eyed bidders. A bidding war ensued, and the lot ultimate sold to Bishop for $514,800. It was offered at TEFAF at €1.5 million (it has not yet been reported sold).

Overall, though not as spectacular as a $40 million sculpture, the mood at TEFAF was good and galleries seemed pleased with their sales.

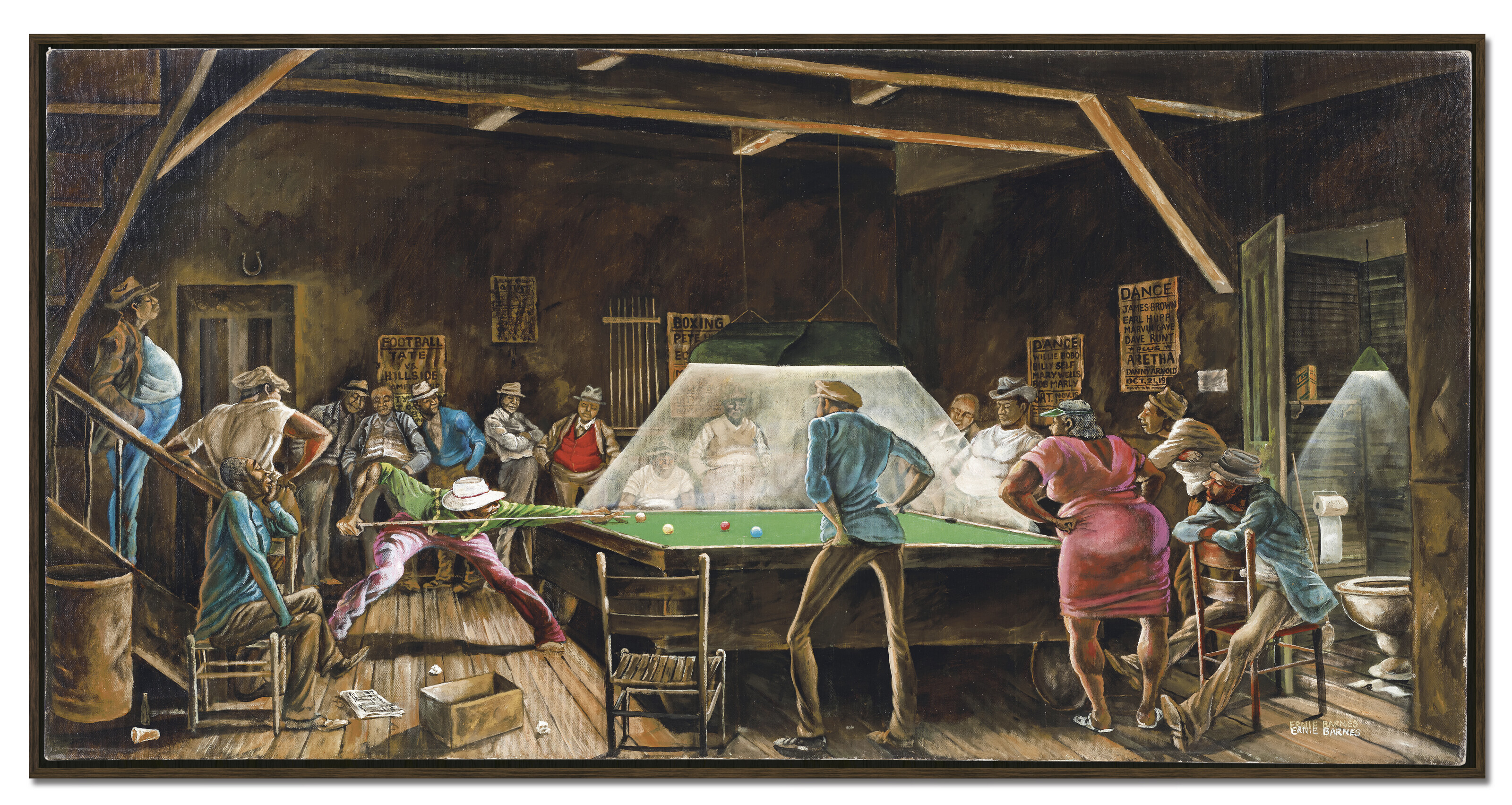

Ernie Barnes, Main Street Pool Hall, 1978, oil on canvas. Christie’s London: sold £1,482,00, estimate: £80,000 – 120,000.

Christie's

Christie’s held the first significant sale of the London season with their 20th/21st century evening sale on 28 June. With an impressive 92% sell-through rate, the sale proved the market had not already been oversaturated by too many high-quality works available in New York and that interest remains steady. That being said, the sale room lacked the same energy as the May sales; results were solid but not extraordinary. It should also be noted that the evening sales across the board have been carefully curated with works selected to sell – and many high-value lots came with guarantees and irrevocable bids which, despite large price tags, made the works considerably less risky to sell.

The top lot spot by value was jointly held by two Monets, with his Waterloo Bridge, effet de brume and Nymphéas, temps gris, both closing around their high estimates and selling for around £30 million each. Surrealism also retained strong interest following Christie’s sale of the Jacobs collection in May, in which Man Ray’s Violon d’Ingres became the most expensive photograph ever sold. In London, René Magritte’s Souvenir de voyage went double its high estimate, selling for £16 million with premiums.

Ernie Barnes made another incredible sale, his Main Street Pool Hall (1978) going for £1.48 million over a very conservative estimate of £80,000 - £120,000. Other painters we’ve been watching, including Shara Hughes and Anna Weyant, performed above their estimates, but did not have the same runaway sales as they did in New York.

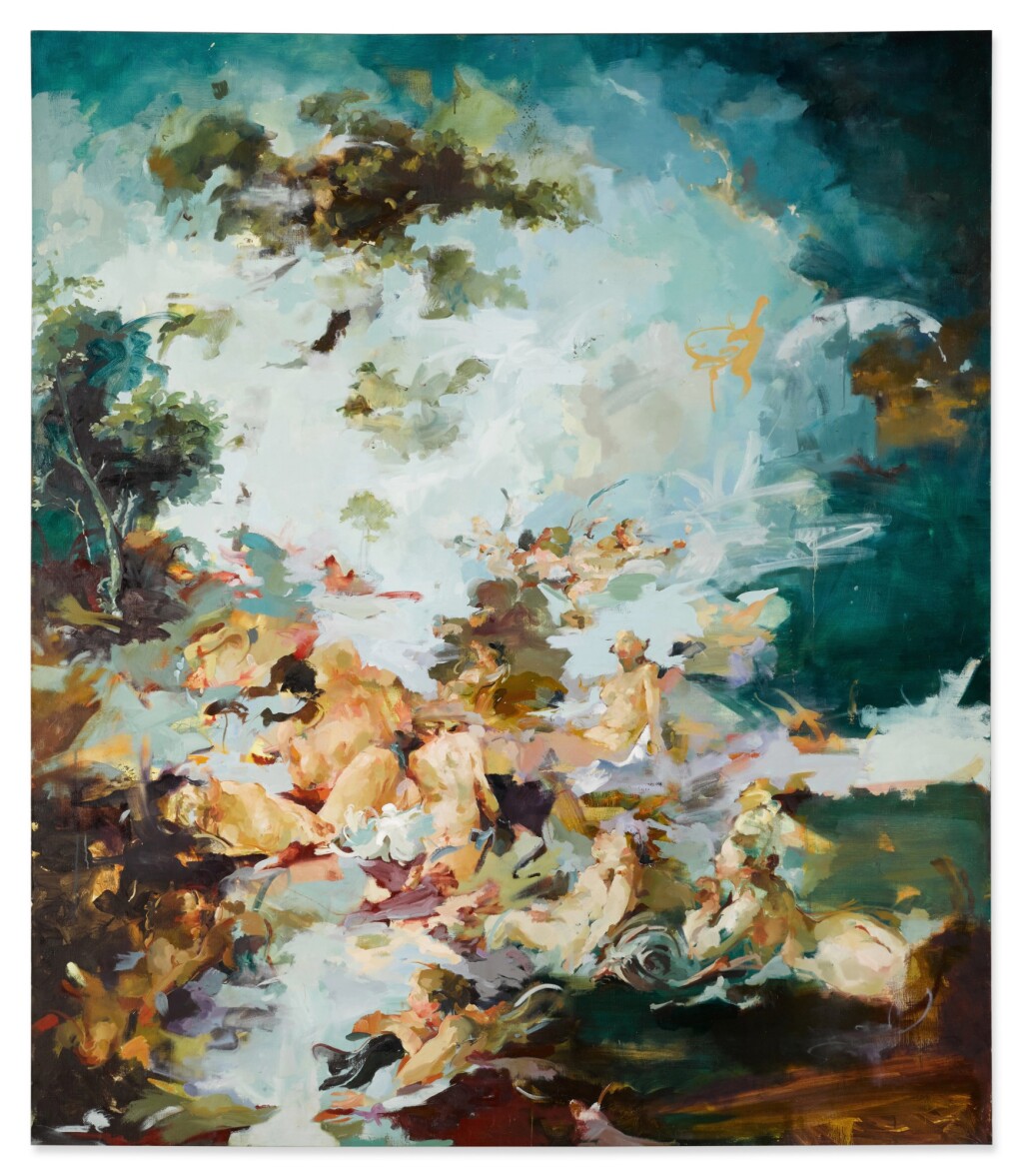

Flora Yukhnovich, Boucher’s Flesh, 2017, oil on linen. Sotheby’s London: sold £2,334,000 with premiums. 29 June 2022.

Sotheby's

At Sotheby’s the star lot of the season was Francis Bacon’s stunning portrait of Lucien Freud from 1964, which was estimated around £35 million; the hammer price came down at £37.5 million. With a guarantee, the only question about the Bacon was whether it would smash records – and it did. It marks a new record for a single-piece work by the artist (he often worked in triptych formats) and is the highest-selling work during a London spring auction. Other pieces in the specially held Jubilee sale performed well, including a cloud study by John Constable. The young Flora Yukhnovich also did extremely well, selling for £1.9 million on an estimate of £200,00 – 300,000.

The modern and contemporary evening sale produced more mixed results; over ten lots were passed on in the sale, including David Hockney’s Woldgate Woods II that carried an estimate of £10 – 15 million. Other top lots, including Andy Warhol’s Self-Portrait, which was very similar to one offered in New York in May, went below estimate and one of his Mao portraits was withdrawn. There were no repeats of the record-shattering Shot Sage Blue Marilyn sale at Christie’s London.

Some additional lots did fare particularly well, including another cloud study, this time by Gerhard Richter, a lovely Pierre Bonnard, and a painting by Swedish playwright August Strindberg that went for three times its high estimate.

Rafa Macarrón, Machaquito, 2011, mixed media on canvas in three parts. Phillips London: sold £327,600, estimate £100,000 - £150,000.

Philips

At Phillips, the short evening sale lasted just over an hour with 35 lots, bringing a combined £17.5 million. Two lots went unsold and two were withdrawn, but unlike Christie’s and Sotheby’s with their much large revenues, Phillips sold through 94% with most lots close to their estimates. There were no blockbuster paintings in the sale and no in-house guarantees, but there were six irrevocable bids.

Young artists continued to achieve great prices: one of the best of the night once again being Flora Yukhnovich (though her lot was guaranteed). The self-taught Spanish painter Rafa Macarrón also sold well, going nearly double the high estimate for his 2011 Machaquito. Paintings by Antonia Showering and Lauren Quin both far exceeded expectations, ultimately selling for around £200,000 each (estimates ranging between £40,000 – 70,000).

The top lot, Cy Twombly’s Untitled (1962) sold below its low estimate and failed to attract any energetic bidding. The auction house admitted it took a cautious attitude towards the sale, which it says was the right call in the face of a slowing market. As seen previously, works by women and artists of color still remain in demand, but some of the artists who achieved high results in New York failed to do the same in London. Some artists who were included in all three sales, such as Shara Hughes saw a drop in price as the evening continued. Others, such as Anna Weyant, remained steady at all three auctions but didn’t achieve the same level of interest across all three sales in London.