FAB Market Insights

Stay informed with our art news and market insights.

Start confidently navigating the art market with tailored guidance for collectors and sellers. Gain clarity on trends, risks and opportunities

The state of the current art market

October and November 2025 have been momentous months in the art market for collectors of fine art. The headlines have to be that the recent New York auctions had some truly wonderful collections and achieved many spectacular results were achieved across almost all sectors. The broad base of collecting from all round the world will surely be a shot in the arm for the global fine art market. Important art fairs in London, Paris and Abu Dhabi also reported good, if not outstanding, sales for fine art dealers.

On the other hand, in the last six months several celebrated galleries, and many less well-known, announced they will close. Buying through a fine art dealer who can impart knowledge and discreetly guide a client’s taste, is still the preferred source for the vast majority of collectors. So these closures will affect new collectors especially.

The costs of running a gallery – rent, staff, promotion, art fairs, exhibitions – increasingly make it hard for fine art dealers to make ends meet. The success of auction houses, especially with their increased action with private sales, means such costs are only justified for secondary market galleries if they can source art privately with good potential profits. Buying from auction is no longer a feasible way of doing business for dealers, given the 26% buyer’s premium and the fact an auctioned artwork would be so known through the massive marketing of auction houses.

Small and medium galleries specializing in contemporary art need the guarantee of artists with regular sales, a hard task as mega galleries constantly pinch the rising stars. Also, In the years 2020-2022 there was an excess of speculation in young artists at auction. Now this has largely stopped, it has reduced confidence and we sympathize with the artists whose livelihood is threatened.

Challenges for Collectors and Sellers and the role of Art Advisors

The art market presents distinct challenges for collectors and sellers. For buyers of fine art, the sheer volume of art available can be overwhelming. Determining fair market value requires expertise and market knowledge, as prices can be influenced by artist trajectory, exhibition history, and condition. Issues of authenticity and provenance are also paramount, demanding rigorous due diligence to avoid costly mistakes. Diligent research helps of course, but an experienced art advisor does this work for you, and much more: sourcing art from private collectors, value assessment, art history knowledge, and global connections.

A large part of an advisor’s time is spent negotiating purchases, administrating export licences and payments, and arranging fine art transport. Advisors save their collectors countless hours

Sellers face another set of hurdles. Choosing the right sales channel – discreet private sale, art fair consignment, auction - can greatly impact the final price. Timing the sale to align with market demand for a particular artist or movement is another critical factor. Furthermore, the transaction process itself involves complex logistics, including contracts, shipping, and insurance, all of which require expert management. Again, art advisors help you decide and can negotiate sales and favorable terms.

With the many buying options available to collectors, and the related pitfalls, the role of the art advisor is becoming more significant in helping collectors source and choose the right artworks, assess value, and have the right documentation and licenses. Equally art advisors and brokers help sellers assess the real market value of their artworks, and also implement discreet sales practices which also maximize their investment.

In today’s nuanced art market, personalized advisory services are an essential resource for both buyers and sellers. A skilled advisor acts as a trusted partner, tailoring guidance to each client’s goals, tastes, and budget.

For buyers, this means access to high-quality works (often through private channels) along with expert research, provenance checks, and negotiation support. For sellers, advisors craft effective sales strategies, leveraging market intelligence and global networks to connect artworks with the right audience.

By demystifying the process and providing objective insight, personalized advisory ensures clients can make confident, informed decisions at every stage of their collecting journey.

While art market data reported in the press is factually accurate, the only available figures are from auctions. The majority of fine art sales, although not many of the high ticket items, are private sales through galleries or online.

November auction report

Ray Waterhouse with a Monet that achieved $45.5m at Christie’s during the 20th Century Evening Sale.

Whilst the vast majority of art buyers collect art under $100,000 - perhaps as much as 98% - it might seem that sales of big-ticket items at Evening auctions don’t have much relevance to general art collecting, but such results do trickle down and affect many areas of the art world, especially market confidence.

But starting with the auction Day sales, which have direct relevance to all art collectors as the majority of lots are estimated between $20,000 and $500,000, these did extremely well. Much better than recently. Day sales are a true barometer of art market confidence. I was told by a Sotheby’s expert that they had 70 new buyers in their Contemporary Art day sale, astonishing proof of new buyers entering the fine art market.

At Christie’s, the Post-War & Contemporary Art Day Sale totaled $88,779,332. The morning opened with seven Alexander Calder works from the Max N. Berry Collections, all of which beat their high estimates.

At the Evening sales, Sotheby’s sold three paintings by Gustav Klimt for a total of $390 million, including a record for any modern work of art (see below) in an evening sale, which also had a drawing by Van Gogh at $11.1 million and a sale total of $706 million. In the Contemporary Now evening sale, a new record was set for Cecily Brown at $9.8 million.

Christie’s sold a single owner collection which brought in $218 million of the total $690 million, including a Rothko at $62.2 million. In the Exquisite Corpus sale at Sotheby’s a Freida Kahlo work sold for $54.7 million, which is a new auction record for an artwork by a woman.

A few highlights:

Gustav Klimt, Portrait of Elisabeth Lederer (1914–16)). Image courtesy Sotheby’s New York.

Sold for $236.4 million

Mark Rothko, No.31 Yellow Stripe (1958). Image courtesy Christie’s. Sold for $62.2 million.

John Singer Sargent, Capri (1878). Image courtesy Christie’s. Sold for $11.4 million.

Cecily Brown, High Society (1998-99) )). Image courtesy Sotheby’s New York Sold for $9.8m

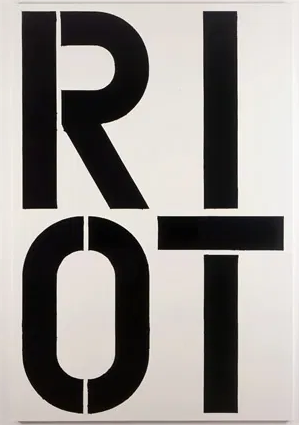

Christopher Wool, Untitled (RIOT) sold for $19,840,000. Image courtesy Christie’s

Art Fairs

Over the last year I have detected a changing perception of art fairs amongst both visitors and exhibitors. For about the last 15 years, art fairs have witnessed an inexorable rise in number and importance for art collectors, and consequently the art dealers who exhibit and sell at them. The largest galleries show at fairs almost every month: in Miami, New York, Hong Kong, Paris, London, Basel, Maastricht and elsewhere, and we recently learnt that Art Basel will begin another fair in Qatar in February 2026.

Both galleries and collectors are showing signs of art fair fatigue, and a number of significant galleries have pulled out from Art Basel Miami in December 2025. This is due to the world-wide proliferation of art fairs and the diminishing returns. Collectors might not realize that to exhibit at a good art fair costs between $100,000 and $250,000 - and sometimes even more. Journalists are quick to point out that the same artworks are often seen at fair after fair, which is not surprising as how can galleries have a constant stream of high quality new material?.

Frieze in London in October is now being overshadowed by Art Basel Paris which takes place the following week. Americans and Asian collectors seem to prefer to enjoy the delights of Paris. Art Miami, which began before Art Basel Miami existed, now has reduced quality and many better exhibitors have withdrawn.

A collector can view between 50 and 150 galleries under one roof at an art fair, and get a feeling for what to buy and different values, and meet dealers and advisors. But while art fairs continue to be an important and integral part of the world’s art market, not all of them can survive at a high level and collectors are being more choosy which they visit.

Ray Waterhouse and Sandra Safta Waterhouse with a client at an art fair.

Art Market Data

Here are a few interesting findings from the recent Art Basel and UBS Survey of Global Collecting 2025:

• According to the latest UBS Survey of Global Collecting, in 2025 collectors allocated an average of 20% of their wealth to art, up from 15% in 2024.

• Galleries and dealers – as opposed to auctions - were still the most used channels for buying art among HNWIs. 83% percent bought at a gallery in person, online, through social media, or at an art fair in 2024/2025.

Among the 71% of respondents who had purchased in 2024/2025:

• 60% had bought an artwork at a gallery or premises (down 17% on 2023)

• 54% had bought directly via a website or OVR without viewing the work in person beforehand (down from 74%)

• 50% had made a purchase via either an email or phone call to the dealer without a viewing (from 61%)

• 51% had bought via Instagram without viewing

Art as an Investment

Art continues to serve as a store of value, but in 2025, it is increasingly treated as part of a diversified investment portfolio. Collectors are balancing passion with pragmatism, seeking works that inspire while also holding long-term financial potential. Transparency in pricing and provenance has become essential to building confidence. Art advisors and fine art dealers can help collectors with such analysis.

For the New Collector

New collectors should focus on education and defining their interests. Visiting museums, galleries, and art fairs helps develop one's eye and identify personal tastes. Starting with a clear budget and focusing on a specific area, such as a particular medium or artistic movement, can make the process more manageable. Working with a reputable fine art dealer or advisor from the outset can provide a strong foundation and prevent common pitfalls.

For the Established Collector

Established collectors often look to refine or expand their existing holdings. The strategy may involve acquiring a ‘trophy’ work by a key artist already in their collection or diversifying into new areas to create a richer dialogue between pieces. They may also focus on legacy planning, considering how their collection will be managed for future generations. Strategic deaccessioning, or selling works to fund new acquisitions, is another common practice that requires careful planning.

For the Seller

For those looking to sell, the primary goal is to maximize returns while managing a smooth transaction. The first step is obtaining an accurate and unbiased valuation, for which one needs an art advisor with a deep knowledge of the market for that artist. Based on the artwork and market conditions, a professional and expert art advisor can recommend the best path forward, whether it is a high-profile auction or a discreet private sale. Preparing comprehensive documentation is essential for a successful outcome.