FAB Market Insights

Stay informed with our art news and market insights.

After two years of unprecedented change in the art market, with some sectors seeing enormous gains, all bets are off when it comes to making art market predictions about trends for 2022. But as we embark on another year of activity at Fine Art Brokers, we attempt mission impossible.

Online art sales

In 2021 global auction sales from Christie’s, Sotheby’s and Phillips totaled $12.6 billion, up 70% from 2020. Sotheby’s reported total sales of $7.3 billion, with online sales topping $800 million. Christie’s, meanwhile, achieved $7.1 billion in sales, with nearly half of all its auctions taking place online.

‘There’s no doubt the pandemic galvanized the art world’s transition online,’ says Ray Waterhouse, Co-Founder of Fine Art Brokers. ‘Thanks to the proliferation of viewing rooms and online auctions in 2021, buying art online became more popular among both traditional buyers and more experience-driven millennials. Though online buying was often the only option last year, the trend looks set to continue.’

The digital transformation also enabled galleries, dealers, art fairs and art advisors to make new contacts remotely and become more global in their outreach, notably through improved online content offerings and increased social media presence.

‘At Fine Art Brokers we have experienced a significant increase in requests regarding collecting and selling art from our website and Instagram, from the US and Asia especially,’ says Waterhouse. ‘Some are for one-off purchases while others are from new collectors with significant budgets and ambitions.’

Waterhouse points out that online buying has skewered general taste so that ‘easy to read’ art by artists such as Yoshitomo Nara and Javier Calleja have experienced extraordinary price rises.

Flora Yukhnovich’s, I'll Have What She's Having, 2020 sold for $3.1 million in October 2021 at Sotheby’s in London. Image courtesy of Sotheby’s.

That said, digital uptake has also made serious collectors hungry for the return of tangible experiences and art that possesses a visceral materiality. ‘This might explain the uptick in interest in young figurative painters such as Flora Yukhnovich whose Fragonard-inspired I’ll Have What She’s Having (2020) set a new auction record for the artist at $3.1 million last October,’ adds Waterhouse.

Asian market boom

While the American investor George Soros is predicting, at the time of writing, a fall in the Asian economy, last year’s auction sales were greatly buoyed by Asian interest. At Sotheby’s, Asian buyers accounted for one third of all bids by value in worldwide auctions, and a staggering 46% of these buyers bid or bought on lots over $5 million.

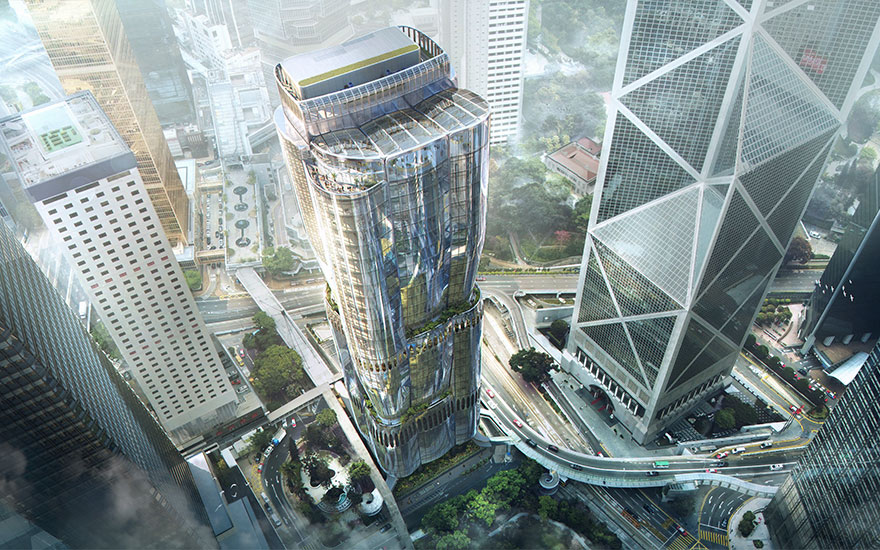

Christie’s reported similar growth in the sector, with Asian buyers contributing a total of $1.68 billion, up 32% on 2019. To accommodate the growing numbers of Asian collectors, Christie’s has announced that its Shanghai outpost is relocating to BUND ONE in the spring and that Christie’s Hong Kong is relocating its Asia Pacific Headquarters in 2024 to The Henderson, a 50,000 square-foot-building designed by Zaha Hadid Architects.

Visualization of The Henderson in Hong Kong by Zaha Hadid Architects for Henderson Land. Rendering by Arqui9. Image courtesy of Christie’s.

The launch of Frieze Seoul in September 2022 also reaffirms the art sector’s commitment to the region. The inaugural edition of the fair, which runs alongside Kiaf SEOUL, South Korea’s leading art fair, will bring together around 100 galleries from all over the world to celebrate the city’s vibrant art scene.

‘In a period of high public interest in the Korean art market, the collaboration between South Korea’s largest art fair and Frieze will confirm Seoul as a hub of the global art market,’ said Dal-Seung Hwang, the Chairman of Galleries Association of Korea, ‘and South Korea a major destination for the art market in Asia.’

What’s more, Seoul’s biggest auction houses — K Auction and Seoul Auction — have allegedly violated an agreement made with local galleries to ensure ‘healthy co-existence’ between primary and secondary market players: both houses now routinely contact artists directly and outstrip the agreed number of annual sales. According to a spokesperson from Seoul Auction, this has occurred ‘to keep up with the market demand.’

‘We’re increasingly busy in Asia, with new clients in South Korea and Hong Kong in particular,’ says Waterhouse. ‘We’ve found that there is an increasing interest in Western art.’

NFTs are here to stay

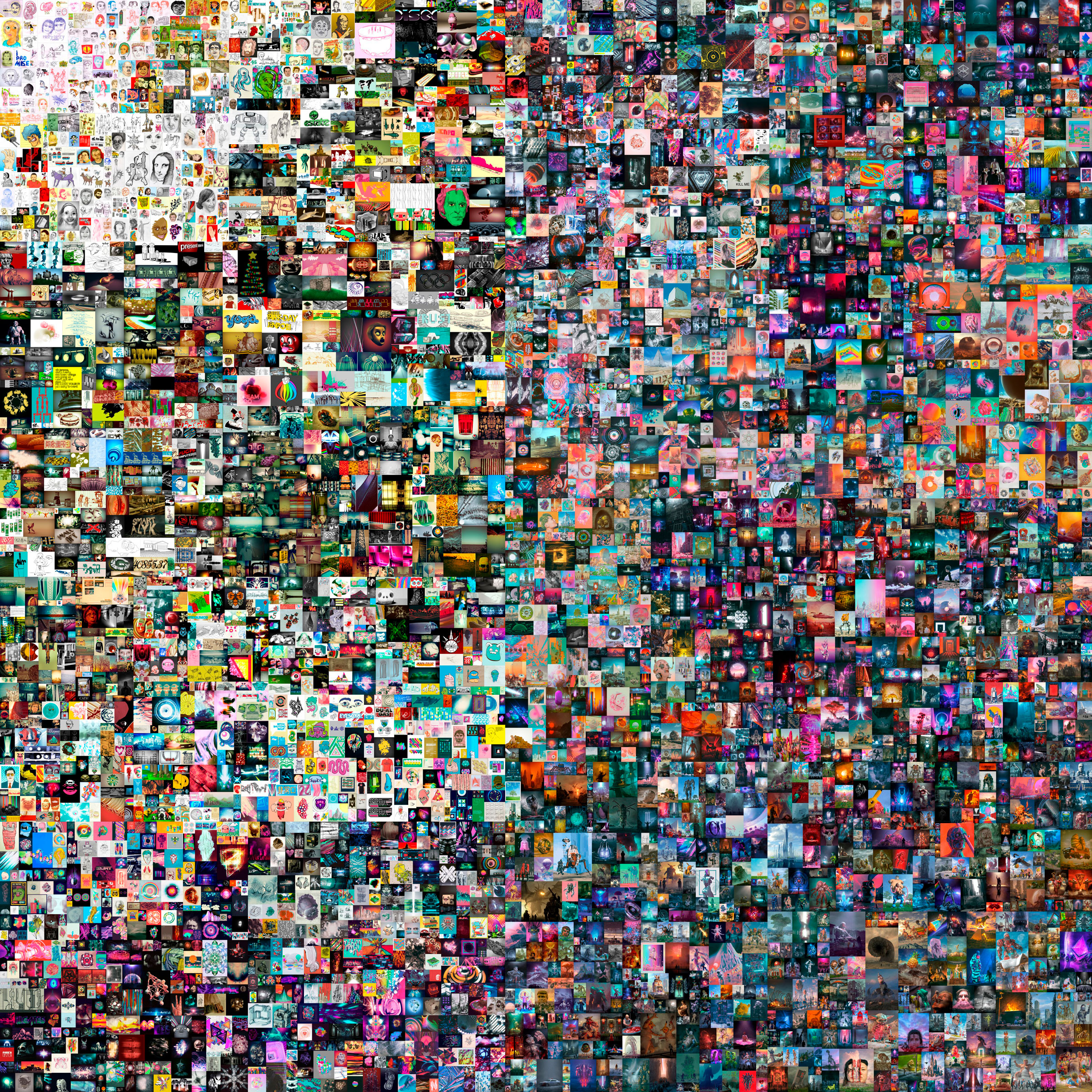

No matter how volatile the NFT market seems, there will be a place for it going forwards. In 2021 Christie’s sold more than 100 NFTs for nearly $150 million, buoyed by the jaw-dropping $69 million achieved by Beeple’s Everydays. Sotheby’s, meanwhile, established its own Web3 enabled NFT marketplace, as did many of the major international galleries including Gagosian, Pace and Hauser & Wirth.

Beeple’s Everydays: The First 5000 Days sold for US$69,346,250 on 11 March 2021 in a Christie’s online-only sale. Image courtesy of Christie’s

In keeping with this shift, 2021 saw the meteoric rise of native crypto-artists such as XCOPY, FEWOCiOUS, Frenetik Void, Hackatao and Slime Sunday and more ‘traditional’ artists embrace new digital technologies.

One such artist was Damien Hirst who launched The Currency, a collection of 10,000 NFTs which corresponded to 10,000 unique physical artworks by Hirst, with the NFTs containing high resolution images of the front and back of each of the 10,000 artworks. It is reported that he earnt $25million from his first edition. Urs Fischer also joined the NFT bandwagon, releasing a series of NFTs with Pace, the first of which sold for $97,000 on the auction platform Fair Warning.

‘It really is impossible to predict if the meteoric rise in the NFT market will continue,’ says Waterhouse, ‘but there is no doubt that the interest and speculation will.’

Increased support of climate solutions

Last year, in response to the growing climate crisis, many of the world’s leading auction houses, galleries and museums reaffirmed their commitment to carbon neutrality, with Christie’s pledging to be net zero by 2030. In line with this goal, Christie’s London offered Cecily Brown’s There’ll be bluebirds (2019), the first of a series of works donated by artists and galleries to help fund Artists for ClientEarth, a joint initiative spearheaded by Christie’s, Client Earth and the Gallery Climate Coalition (GCC) to combat climate change.

Founded by a voluntary group of London-based gallerists and professionals working in the commercial arts sector, the Gallery Climate Coalition seeks ‘to facilitate a reduction of the sector’s carbon emissions by at least 50% by 2030’. It offers its members free, easy-to-use online tools such as a carbon calculator to help estimate the carbon footprint of their business.

Museums are also taking steps to reduce their carbon footprint. ‘The current climate situation requires immediate action,’ Gitte Ørskou, the director of Moderna Museet in Sweden, told The Art Newspaper in November. ‘We ask ourselves if we should ship artworks, what we should print and how we can serve more sustainable food in the restaurants.’

Ray Waterhouse with a Fine Art Brokers client

‘We’re also helping our collectors to reduce their carbon footprint by embracing more sustainable collection management practices,’ says Waterhouse, ‘and making savvy decisions when it comes to art logistics. For example, we’d now suggest shipping rather than flying artworks whenever possible.’

Despite progress in art logistics, the climate controversy swirling around NFTs will rage on. Most NFTs are registered on the Ethereum blockchain, which has been widely criticized for its considerable carbon footprint. Waterhouse is keen to point out, however, that headway is being made on this front.

The online marketpalace misa.art, for example, uses an alternative blockchain platform that consumes considerably less energy per transaction, while artist John Gerrard has launched regenerate.farm, an Ethereum crypto fund for climate and soil regeneration. Companies like CurrencyWorks, which turns oil waste into environmentally friendly energy that powers crypto mining, are also ensuring a more sustainable crypto future. ‘In the face of the ongoing environmental crisis, it is essential that the whole sector adopts greater responsibility and makes effort to offset its emissions this year and beyond,’ notes Waterhouse.

Continued need for flexibility

With a persistently volatile Covid-19 situation, it seems the market will ebb and flow to Covid’s tempo. Activity will likely accelerate when viral transmission is low and decrease when the opposite is true. Fairs, galleries and museums will have to remain flexible to accommodate new variants and unexpected changes in government guidelines.

TEFAF Maastricht 2020 Courtesy of TEFA

TEFAF Maastricht is a case in point. The fair was quick to respond to the recent Omicron outbreak, postponing its 35th anniversary edition from March to June. Until Covid-19 is in the rear-view mirror, Waterhouse expects timed entry and diligent protocols to remain firmly in place. ‘It’s a simple means of offering visitors reassurance in a time of uncertainty,’ he says.

It appears that hybrid events are here to stay too. ‘Fairs will continue as essential places of physical networking, but will be coupled with an online offering,’ notes Waterhouse. ‘Viewing rooms are easy and cheap to maintain and have extensive reach, so there’s little incentive for galleries and fairs to abandon them now, especially when international travel remains so problematic.’