FAB Market Insights

Stay informed with our art news and market insights.

After 40 years working in the art market, I have met many highly successful people who, despite their life and work experience, were too intimidated when walking into an art gallery or auction house to discuss what they saw. On the other hand, there are even more examples of successful business people who aren’t apprehensive at all, and believe they can transfer their winning mentality to buying art. And there are other collectors or would-be collectors who simply don’t have the time or expertise to buy wisely.

These are just a few examples of who would benefit from working with an experienced advisor when diving into the $68 billion art industry. Good advice isn’t necessarily expensive. I often save collectors money by helping them buy art at the right price, and importantly by avoiding expensive mistakes. There are so many factors to consider when acquiring art, whether from a young, emerging artist or a blue-chip Impressionist. Due diligence is needed at all levels.

It’s important to choose an advisor who has the relevant knowledge and contacts in your field of interest. Experienced advisors can recommend which of an artist’s work is worthy of your attention, taking into account many different factors, such as date, condition, subject-matter and provenance.

I find one of the most important ways I help collectors is by sourcing art they wouldn’t have access to, whether from private collections, direct from artists, obscure auctions or from global contacts. An example is the painting illustrated below by Roby Dwi Antono, a highly sought-after artist, which I was able to source on the UK primary market for a collector in Seoul.

Roby Dwi Antono, The Great Gig in the Sky, 2023. Sourced in the United Kingdom for a private South Korean collector.

Advisors such as Fine Art Brokers usually also act as a guide and educator, taking clients to art fairs and auctions. Such visits are enormously beneficial for both parties – the client gets to see hundreds of artworks and meet dealers and other experts, and the advisor learns about the clients’ sensibility and taste. I of course offer my opinion on quality and value when asked, but always leave the final decision to my client.

Advisors can also negotiate prices – especially in the secondary market when our inside knowledge helps. We can also be a welcome bridge – both as a connector, and alternatively as a barrier when collectors wish to remain anonymous – to sellers and other agents. An example is the Picasso work on paper below, which I acquired for a client at auction – he relied on me to view the work and report on condition and the price to bid, and he asked me to bid as he did not want his name known to the auction house.

Pablo Picasso, Nu debout, mousquetaire et enfant, 1967. Purchased on behalf of a private client.

How to choose an advisor

It can be remarkably hard to find the right advisor. Websites don’t convey someone’s personality, and an advisor’s approach and compatibility are as important as expertise and connections in a successful client relationship. I always have discussions with clients before each side commits to working together.

Trust is also crucial, of course. I publish some testimonials on our website which act as reassurance, but also give personal references when required.

The choices vary from large corporate art advisory firms to advisors working on their own. Each have their advantages and disadvantages. A big company will have offices in various countries providing international services, support in various ways from expertise and research to logistics. But a corporate structure might not suit all collectors. A one-man band can offer a very personal service but will clearly have restricted expertise and outreach, and perhaps some client conflicts in the busy seasons.

Of course, we think our team of five experts at Fine Art Brokers is the perfect size. We have a wide range of expertise, from mid 19th century American and European art to ultra-Contemporary, including an expert in logistics and shipping. (I have to say that however long it takes to acquire an artwork, arranging shipping and installation is always incredibly time consuming and we arrange all this within our one fee). We work with galleries, dealers, artist studios, and auction houses on our clients’ behalf to secure the best works, most favorable terms, and ideal purchase conditions.

The location of an advisor need not be a factor given the internet, zoom and air travel. But it is important that the advisor is willing and able, within reason, to view works you are interested in, or to trust colleagues who can view on his or her behalf.

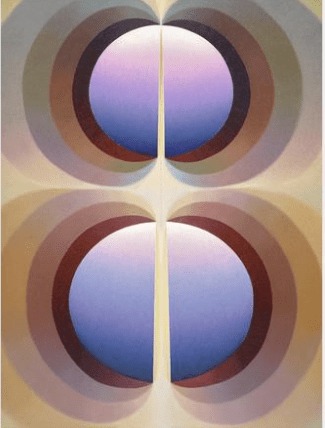

Loie Hollowell, Split Orbs in Purple, Ochre and Brown, 2021. Purchased on behalf of a private client in 2023.

An Advisor’s Market Knowledge

It is our responsibility as advisors to use our deep market expertise and exposure to recommend or deter purchases or sales, to inform clients about artists or artworks for sale that may be of interest, and to research and comment on value and authenticity. Also, we illuminate the important points of what sets apart one work from another, why one artist is a better buy than another, and when and why is the right time to buy or sell.

Clearly, it’s helpful to choose an advisor who can act proficiently in your area of interest. This is especially true in Contemporary art when knowledge of the latest trends and access to in-demand artists is very useful. If you are interested in buying an artwork on the secondary market, an Impressionist or a Post-War painting for example, a consultant with specialist knowledge of the subject and contacts with owners and museum curators could provide significant impact on advice received.

However, there are common threads to all art collecting, except perhaps in Ultra Contemporary, so that an experienced advisor with a great eye and good art market experience can usually help in areas outside his or her specialist expertise. I, for example, have most of my academic expertise in European Post-Impressionist and Modern art. Yet I have been able to apply my experience to creating world class collections of 19th century American art (specifically Hudson River School paintings), Norman Rockwell and Post-War art.

I recommend using an advisor with both art market and academic experience. Look for someone with direct experience in the art market, such as prior work in galleries or auction houses. An advisor should also have a degree (or degrees) in art history, demonstrating engagement with the historical significance of works one might encounter in the market, though this knowledge will likely be more specialized and narrower when a broader experience with market works may prove more advantageous.

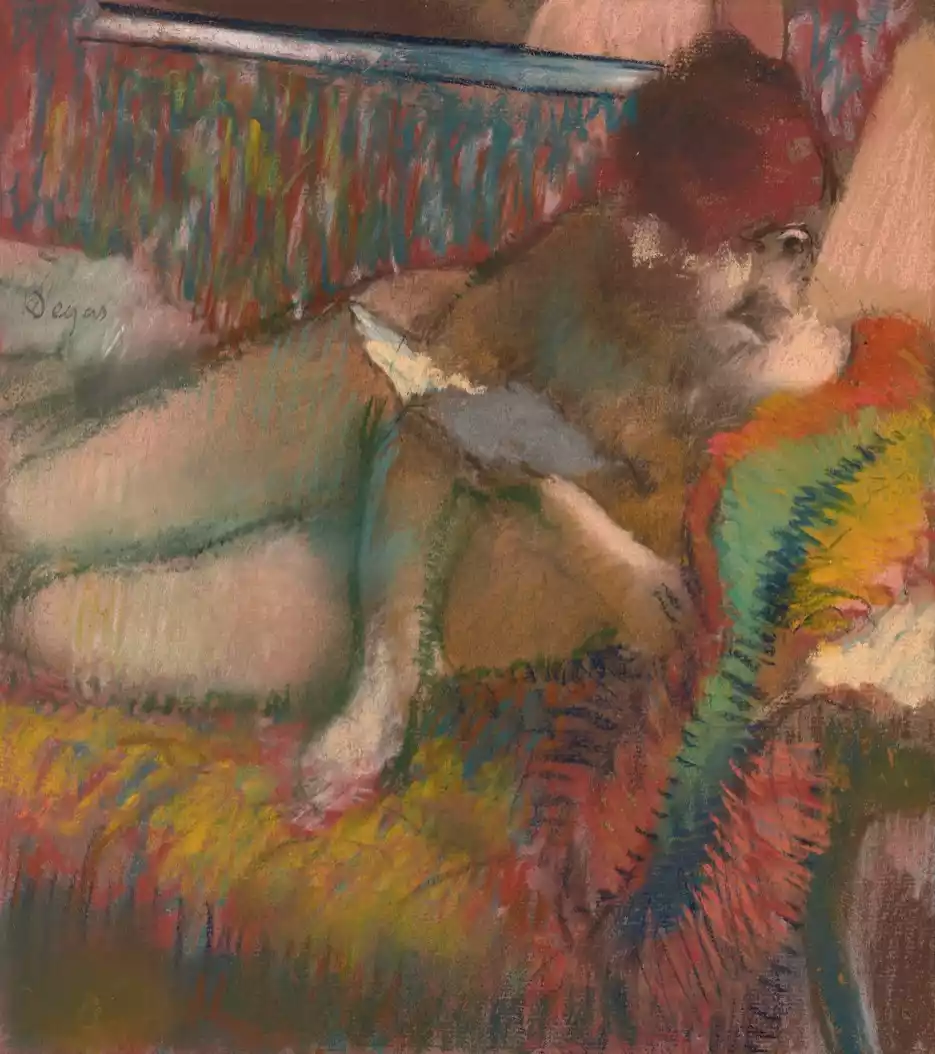

Knowledge of relevant museum exhibitions and personal connections to museum curators is an important asset for an advisor. In the last few years I have arranged loans of paintings owned by my clients to museum exhibitions at the National Gallery in London, The Getty in Los Angeles, The Musée d’Orsay in Paris and The Metropolitan Museum in New York, for example, which can substantially raise the artworks value. One example is the pastel by Edgar Degas illustrated at the top of this article, loaned to the National Gallery, London, for the 2023 exhibition Inventing Impressionism.

While there are of course exceptions, I would be wary of advisors working on their own with only a Sotheby’s degree or experience as a decorator, for example. Ideally one should work with somebody who has direct experience of buying and selling.

I have over forty years’ experience in the art market and have run Fine Art Brokers since 1996. I have brokered art from two $20 million 19th century masterpieces to works by Contemporary artists such as Annie Morris and Loie Hollowell. I have bought and sold over 5,000 works of art.

My colleagues have complementary experience: Sandra Waterhouse and Paul Carney are Modern and Contemporary experts, Caitlin Link in 19th century and early 20th century, and Hélène de Saint Chamas in Paris in a wide range of European art.

We provide the access to the most exclusive sections of the art market, whether in galleries with waitlists, global auction houses, or our extensive network of dealers and gallerists around the world. We always keep our ear to the ground, constantly scouring fairs, sales, and other market sources, listening for any news of works on offer that are of interest to you, are good buys, and will suit your collection.

In addition to sourcing, art advisors also introduce you to new artists, keeping an eye on market trends and what might stay relevant for years to come or fizzle out quickly. With a dizzying array of artists, galleries, and art fairs to manage, it is our job to do the legwork for you and come back with suggestions. The FAB team travels regularly, visiting all major art fairs in New York and London as well as Art Basel in Basel and Miami, TEFAF in Maastricht, and other fairs on a more occasional basis. In 2022, for example, we visited Frieze Seoul to meet with Korean clients and advise on their collections.

Pricing and Value

One of the most important tasks for you art advisor involves evaluating artworks that are being considered for purchase or sale. There are many tools that are used in pricing various works of art, including databases of previous auction records, but these need to be used judiciously and with experience. Many mistakes are made when comparing an auction result, for example, with a work you are looking at. Is the condition the same? And the date? The current value depends on a number of variable factors and looking at images of works which appear similar in a small online photo rarely conveys a fair comparison.

For example, auction house prices fell by 22% in 2022 compared to the same period in 2021. An expert advisor will know the difference and when marks a time to buy. Previous prices for particular artists, ranging from Picasso to Damien Hirst, need to be evaluated with real knowledge.

A good example is the Matisse illustrated above. We advised a New York client on the purchase in London in 2000, when he didn’t see the painting until it arrived in his apartment. As the market for Matisse was red hot in 2006, we encouraged him to take advantage and it sold for $21.5 million. He had paid $7.5 million.

Fees and Services Offered

Most art advisors charge a flat rate, often 10%, on the purchase price, with a lower rate on high value pieces. For regular clients a retainer plus a small commission might be negotiated.

At Fine Art Brokers, we are committed to a ‘No Deal, No Fee’ policy. We charge one fee which is only charged if we conclude a transaction, and which includes all research, viewing, negotiations, and administrating a purchase or sale. Our fees are low for the industry and are based on a sliding scale, with the low range at 3% and the highest at 10% depending on value on the negotiated price of an artwork.

Other costs to consider when buying art include buyer’s premiums at auction (usually around 25% of the hammer price), shipping and storage fees, restoration work, framing, and installation. All of these can be a surprise if transparency is not provided up front and care is not taken If a work requires expertise regarding authenticity by the renowned expert opinion, this can also be a cost. This process will need to occur before a work can be sold, and the requisite expert will often need to examine the work in person, incurring expensive shipping costs and fees for certification. Respectable art advisors will be clear about their fees and processes up front in initial consultations and will delineate costs that arise in the process of working with them.

One additional, but important, fact to consider is import tax. Different countries have different rules on taxes. The US is unusual in not having import tax on art, but while US collectors avoid sales tax on overseas purchases, use tax might be applicable on entry. Art entering the EU has VAT at varying rates but approximately 6%, while some countries in the Far East have import taxes as high as 30%.

We hope you find the right advisor to suit your taste and requirements. If you want to chat, please call us on +1 212-717-9100 or email me directly on ray@fineartbrokers.com.

Ray Waterhouse

With research by Caitlin Link

Top image: Edgar Degas, Femme lisant, pastel over monotype on paper. Purchased on behalf of a private client and recently loaned to the National Gallery, London, for their exhibition Inventing Impressionism.