FAB Market Insights

Stay informed with our art news and market insights.

Fine Art Broker's is pleased to share the 2018 Market Analysis written by Rachell Pownall, Professor of Arts and Finance at Maastricht University and author of the TEFAF Art Market Report 2017.

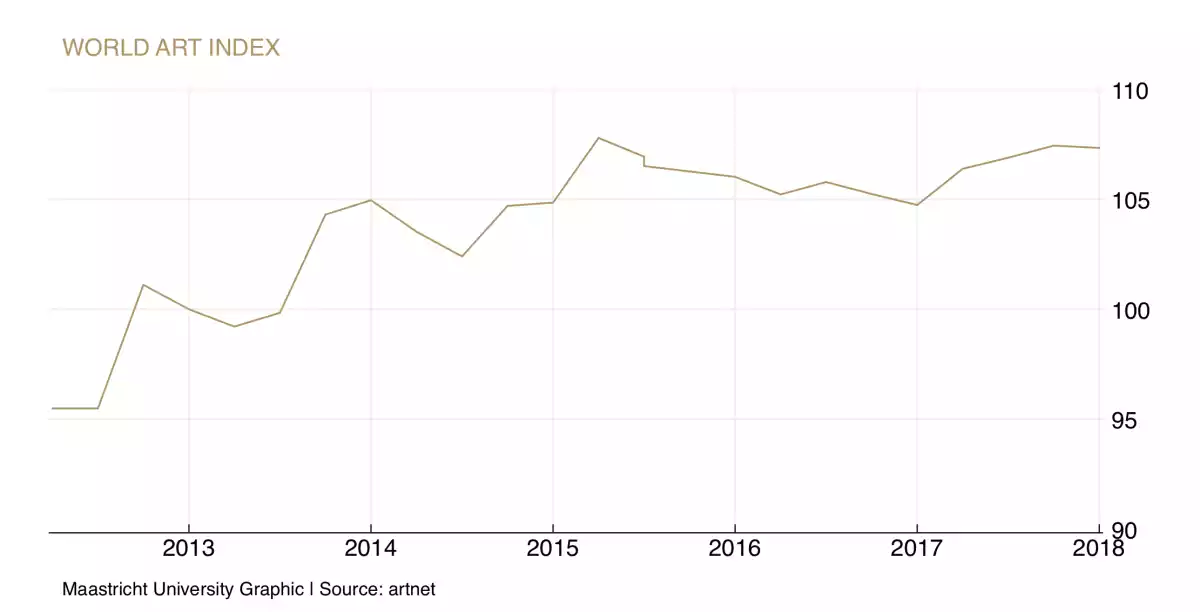

Global auction sales provide a barometer for how the art market is performing. During 2017 we experienced a rise in world auction sales, following a steep decline during 2016, when the US and UK auction sales markets dropped in terms of sales. Much of this drop in sales revenue during 2016, as recorded by a fall in volume, can be attributed to a shift in sales to the dealer market. Prices dropped in 2016 by far less than the auction market as a whole providing an indication that although volumes fell at auction, values were not susceptible to this same drop. In 2016 world art prices dropped by just over 1% over the year, and during the period from 2017 until the first quarter in 2018 we see a rise of just under 2.5% in world art prices.

A reliable and proven method to analyse prices in art markets is to analyse how prices have moved over time, is to use auction sales data, which are reported globally. In this report we use auction sales data collected by artnet, who provide data on over thirty thousand auction houses globally, of which all of the largest auction houses are included, thus providing an almost exhaustive and fully representative sample of the population of auction sales data. The data enable us to produce an art price index for the overall market, as well as sub-sectors of the market. The advantage of using such indices over average prices is that they control for all aspects of artworks, such as high-end prices and the particular artist.

Art price index overall world market.

During 2017 the price of fine art has increased following the decline in the market during 2016 and is now back to its previous peak during 2015. Over the past five-year period we find that the average return has been half a percent per annum for world art prices. Modern and Post-war artworks show a similar performance. The

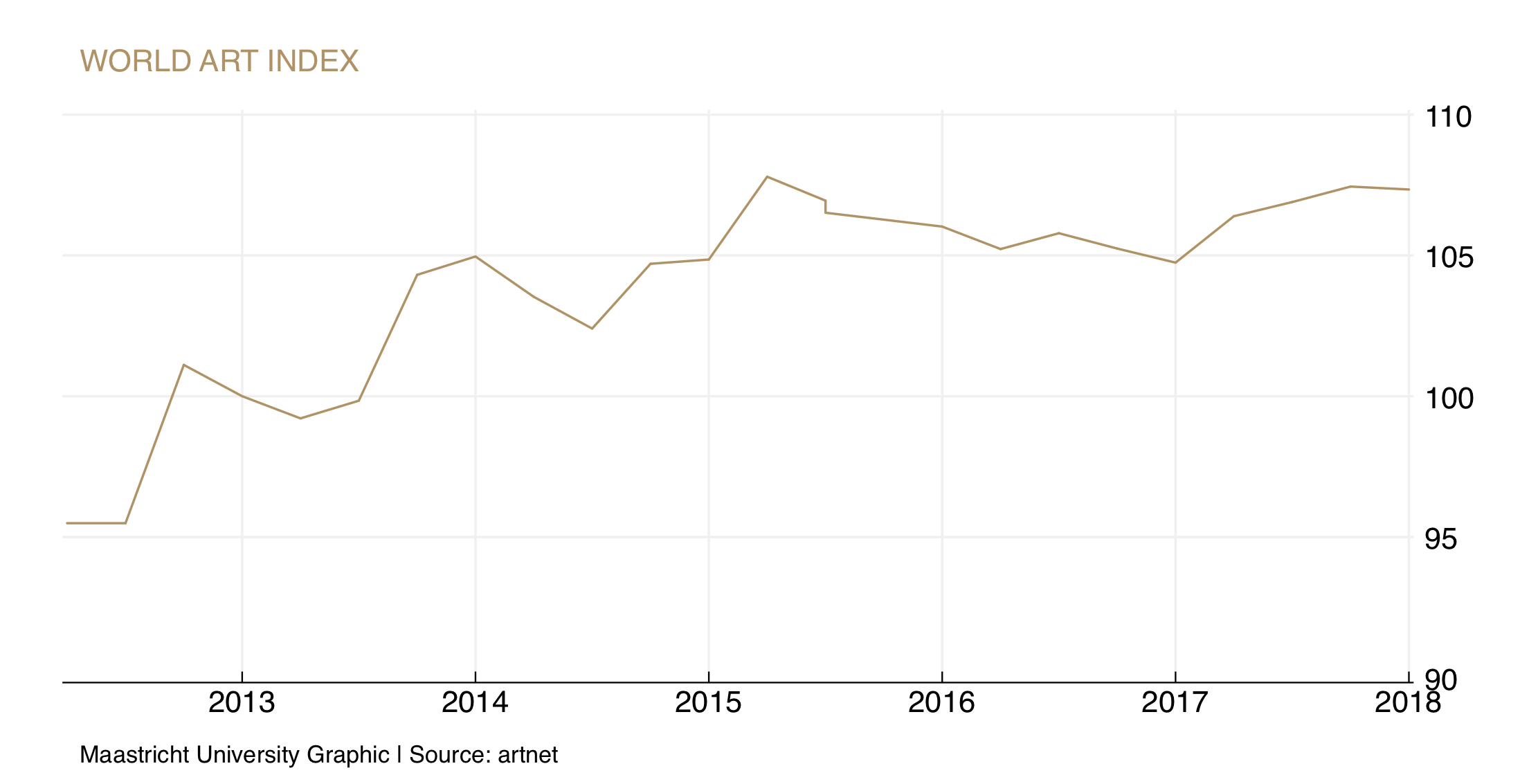

Impressionist and Post-Impressionist market has shown lower, stable growth at just 0.05%. The Contemporary art market has shown the largest growth, with a 0.88% rise on average annually in prices. Impressionists and Post-Impressionist paintings are defined by those artworks which are sold by artists born between 1821-1874. This includes artists such as Manet (b.1832), Degas (b.1834), Monet (b.1840), Renoir (b.1840), Matisse (b.1869). In particular when we focus on the Impressionist and Post-Impressionist market we find that auction sales prices in the market have been extremely stable over the past five years. Rebasing the index in 2013 to 100 we see relatively the market showed a drop during 2013. Over the past four years the impressionist and Post-Impressionist sales prices at auction show that the market is showing stable prices at auction, with an increase during the past year of just under one percent.

Prices in the Modern market have increased since 2012 and the market has accelerated during the past three years. Prices have provided positive growth for artists born between 1875-1910, such as Picasso (b.1881), Modigliani (b.1884), Chagall (b.1887), Rothko (b.1903) and Bacon (b.1909). During the past year, the art index for Modern art grew during 2017 by almost 4%.

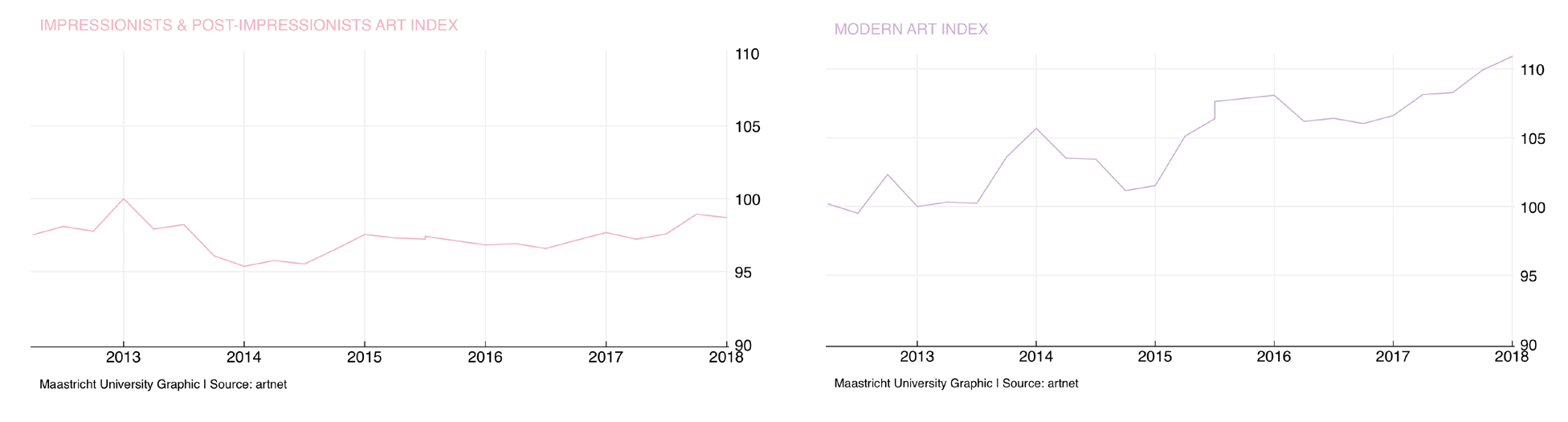

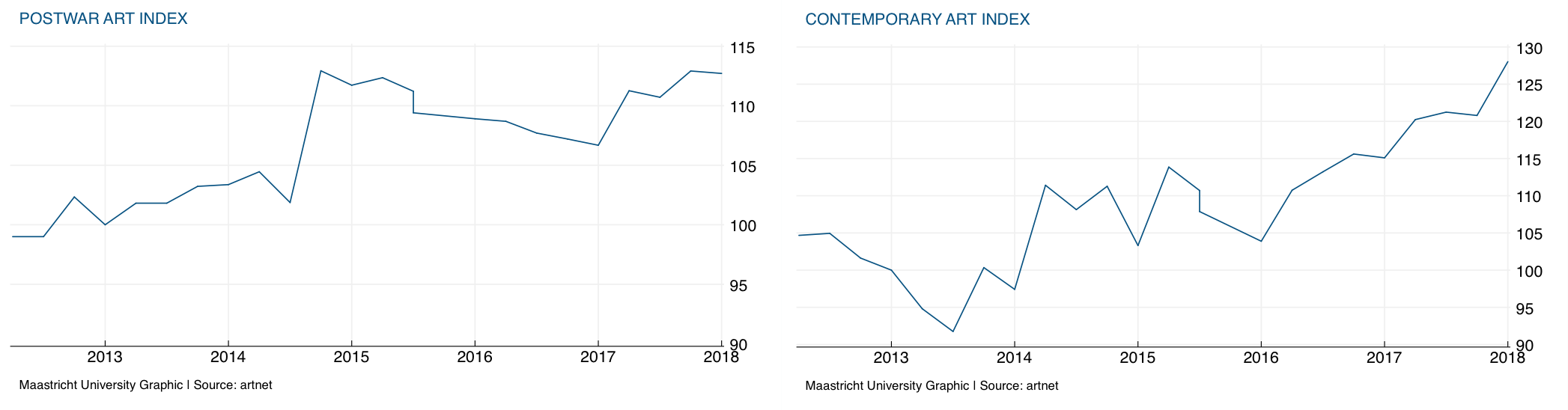

Post-war paintings are defined by those artists who were born between 1911-1944, such as Freud (b.1922), Twombly (b.1928), Warhol (b.1928) and Richter (b.1932). The market peaked at the start of 2015 and in line with global art prices the market experienced a slight fall during 2016 and grew again during 2017 by 5.5%. Both the Post-war and Contemporary markets have seen an upswing during 2017, with prices in the Contemporary art market increasing by over 10%.

We see that artists such as Doig (b.1959), Basquiat (b.1960), Saville (b.1970), and Ghenie (b.1977), defined in the sector of Contemporary artists - all those who are born after 1945 – have shown strong growth over the past five years, growing at 27% over this period. During 2016 and 2017 we find that Contemporary art prices have grown at more than 10% per year, fueling a strong buoyant market.

Rachel Pownall,

Maastricht, April 2018

DISCLAIMER: This report has been prepared by Prof. Dr. Rachel A. J. Pownall, School of Business and Economics, MACCH, Maastricht University. The report reflects the opinions of the author, and is provided in good faith on an “as is” basis. We take reasonable care to check the accuracy and completeness of the report prior to its publication. However, the report has not been independently verified. In addition, statements in the report may provide current expectations of future events based on certain assumptions. The variety of sources from which we obtain the information in the report means that we make no representations and give no warranties, express or implied as to its accuracy, availability, completeness, timeliness, merchantability or fitness for any particular purpose. Except where stated otherwise, the author is the exclusive owners of all intellectual property rights in all the information contained in the report. Any errors pertain to the author.