FAB Market Insights

Stay informed with our art news and market insights.

The results from the May auctions in New York created a mixture of emotions; excitement, surprises, a few disappointments, but overall confirmation that the art market is active and stable. Some artworks exceeded expectations, some of which we describe below, but overall there was a good sell through rate. Most vendors were pleased (or relieved). One of the main headlines of the week was the failure of Alberto Giacometti’s Grande tête mince at a reported reserve of $65 million. This headline grabbing flop was in fact not an example of a failing art market, rather the vendor’s initial reluctance to take a reasonable reserve and a later refusal to accept an irrevocable bid before the sale, which I believe was $55 million. I was involved in guaranteeing two other Giacometti sculptures, and both sold.

As an art advisor with many years’ experience in the art market helping collectors build a collection and also helping collectors sell certain pieces, and generally helping to create fine art investment strategies, I see opportunities for both buyers and sellers. In the secondary market, prices are holding up well for properly priced works, especially those fresh to the market, but if something is considered over-priced or has negative issues, such as a condition problem, then there are many other options for a collector to consider.

And for art buyers, other than at the very high end, there are many more options than two years ago. We have recently been able to negotiate favorable terms with sellers, arrange to reserve pieces while we consider, and generally have comfortable discussions.

For primary market contemporary art, galleries are now rarely selling out shows before they open, and overall offer a calmer environment for art collectors. We have been able to help a number of clients acquire excellent pieces by emerging artists at good prices.

The week’s auction numbers, based on data provided to me by ARTDAI, show $1.26 billion in sales with a weak hammer ratio of .89. That’s below last year’s $1.39 billion in overall sales and .99 hammer ratio. The important Giacometti certainly affected those results but of more significance was that there were fewer star lots than last year. Almost the exact same number of lots were offered this season as a year ago: 1,517. And the sell-through rate in this period was only a tiny bit lower, at 82 percent, than the 83 percent in 2024.

Christe’s started the week strongly with the Leonard & Louise Riggio collection, which totaled $272 million with 97% sold by lot. A top lot included the Piet Mondrian, Composition with Large Red Plane, Bluish Gray, Yellow, Black and Blue, from 1922, which made $47.6 million with fees. That’s slightly below the $50.6 million and $51 million paid for similar works in 2015 and 2022. Claude Monet’s Peupliers au bord de l’Epte, crépuscule, from 1891, made nearly $43 million with fees. The 20th Century Evening Sale followed and totaled $217 million with 100% sold by lot.

Christie’s day sales of Impressionist and Modern art were 10 percent higher than last year, with works on paper seeing an 86 percent sell-through rate. There were strong prices for works by Amedeo Modigliani, Salvador Dalí, René Magritte, Auguste Rodin, Camille Pissarro, and Pablo Picasso.

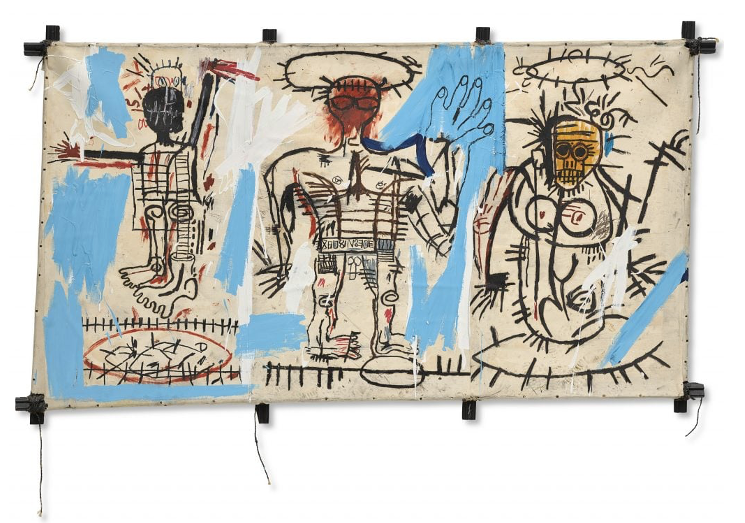

At Sotheby’s Modern sale on Tuesday night a Jean Arp sculpture sold for almost two and a half times the estimate. Giacometti’s Femme debout (Poseuse I), which I helped guarantee, sold for a hammer price $1.8 million above the low estimate. And the following night Christie’s held a sale of 21st-century art that pulled in $96.5 million, beating the $80.3 million that the same sale totaled last year. The top lot of the night was Jean-Michel Basquiat’s Baby Boom (1982), a large painting said to depict the artist and his parents, which sold for $23.4 million

Jean-Michel Basquiat, Baby Boom, 1982. Courtesy Christie's.

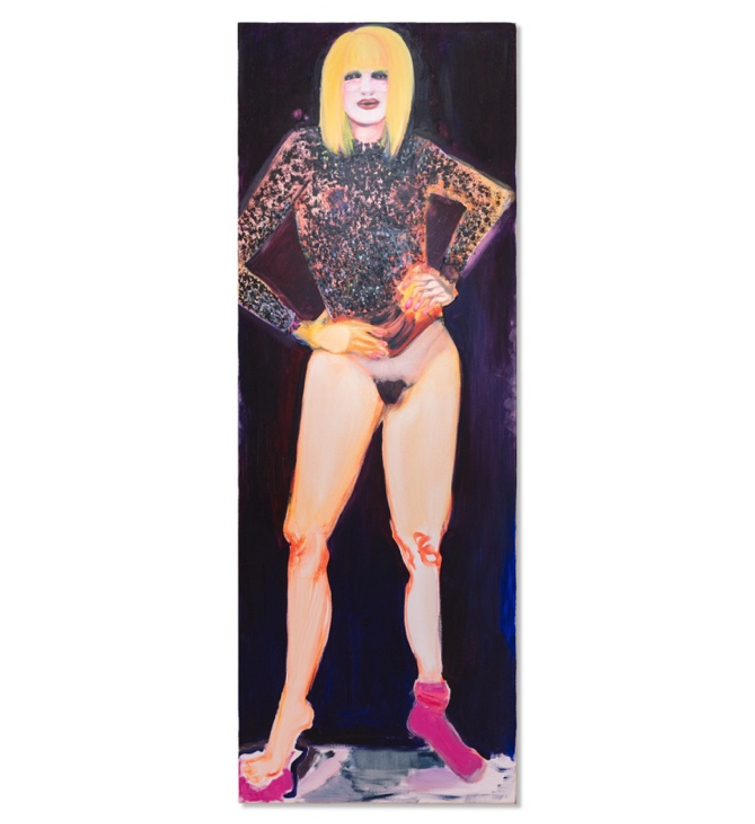

Another positive highlight was a new record for a living woman artist at auction, when Marlene Dumas’s Miss January (1997) sold for $13.6 million at Christie’s 21st Century Evening sale. Dumas’s previous record, set in 2008, was $6.3 million.

Marlene Dumas, Miss January, 1997

Overall, the top of the market has the weakest hammer ratio and the strength of the bidding increases as we go down the quintiles. The two lowest quintiles saw stronger hammer ratios this year than last year. That indicates the bidding pressure for lots estimated below $100,000 is continuing to build.

Art Fairs

In addition to the auctions, New York City was bustling with art fairs last week. Frieze New York wrapped its 2025 edition at The Shed on Sunday. We attended the opening and it was really busy with good buying energy. The fair drew 25,000 visitors from 60 countries over five days. Sales reflected fairly strong demand, but most galleries played more conservatively than in recent years.

White Cube recorded numerous sales, including a Tracey Emin painting for £1.2 million, Hauser & Wirth sold over 25 works by early afternoon of the opening day, including significant pieces by Lorna Simpson, Rashid Johnson and Amy Sherald.

Gagosian noted a “phenomenal” response to its presentation of Jeff Koons, with works placed, including Hulk (Tubas), in the early hours of the first day.

We really enjoyed visiting TEFAF New York as it opened. TEFAF always delivers museum quality booths and we saw a number of sales on opening day. David Zwirner opened the fair with a solo presentation of elegantly suspended sculptures by Ruth Asawa. The gallery sold four sculptures priced between $320,000 and $2.8 million and six works on paper priced between $50,000 and $160,000. We returned on the final day and most dealers were happy, and a few colleagues have told me they have concluded sale after the fair closed.

We also attended the opening of Independent fair downtown. The fair is somewhat compromised by being on 5 levels, and the layout of the booths does not provide the best viewing options, but the building does have a spectacular rooftop bar which we enjoyed with clients. Two exhibitors I know were ‘satisfied’ with results, in other words not ecstatic, but intend to return next year.

As the art world navigates economic uncertainties and shifting collector priorities, galleries, artists and auction houses are adapting by curating shows and negotiating sales that are geared towards pleasing existing collectors and reaching a new collector base for fine art. Auction houses now officially accept Bitcoin. And after Sotheby’s held their first auction in Saudi in February, the announcement that Art Basel is starting yet another venue for an art fair, in Doha, certainly shows the emergence of a new collector base.